With an estimated $24.9B worth of NFTs sold in 2021, the NFT market is booming. That being said there has been a growing number of complains about NFT marketplaces (e.g. OpenSea..) where people are selling fake NFTs, or NFTs that do not belong to them. Some of those NFT marketplaces have also been victims of phishing attacks. With that in mind, OpenSea, valued at $13.3B after its latest round of venture funding, said earlier this year that more than 80% of the NFTs minted for free on its platform were “plagiarized works, fake collections and spam”. As a result of that, the daily trade volume for NFTs on OpenSea dropped by 80% to $50 million throughout March, as opposed to the $284 million in trade volume reached in February. Those types of issues have become a concern for many NFT marketplaces, but those marketplaces are starting to take the proper actions to address them. In this analysis we will discuss the key issues and provide solutions and recommendations to teams on what they should look for when selecting an NFT marketplace or launching an NFT solution.

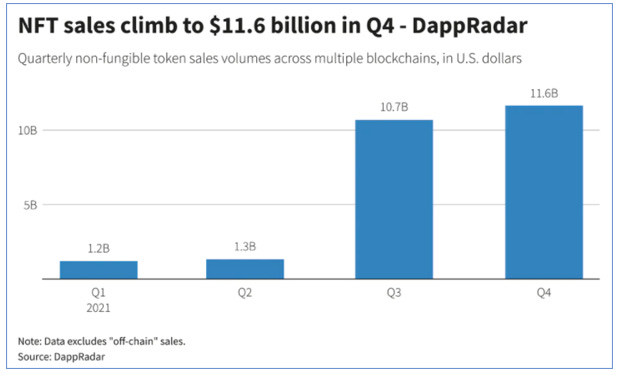

NFT sales were booming in 2021, with an estimated $24.9B worth of sales

In 2021 the NFT market had a very strong year. In fact, NFT sales volume totaled $24.9B last year, which was up from $94.9M in 2020, according to DappRadar. Of note, DappRadar collects data across ten different blockchains, which are used to record who owns the NFT. In the Art world, one NFT artwork even fetched a record $69.3M at a Christie’s sale in March 2021. Not surprisingly, some of the world’s top brands such as Coca Cola and Gucci, are entering the NFT space and are now selling their NFTs in order to bank on this new opportunity.

Picture: NFT sales volume, DappRadar

it is also worth pointing out that some other research firms estimated the total size of NFT volume sales for 2021 to at $18.3B (source: CryptoSlam) or $15.7B (Source: NonFungible.com, which tracks the ethereum blockchain only). Just to put things into perspective, the money spent on NFTs in 2021 was roughly equivalent to the amount pledged at COP26 to help countries phase out coal, or the funding made available by the World Bank to buy and deploy COVID-19 vaccines.

NFT sales fluctuated in 2021 as they peaked in August, then declined in September, October and November before picking up again in December, according to the data from the biggest NFT marketplace, OpenSea.

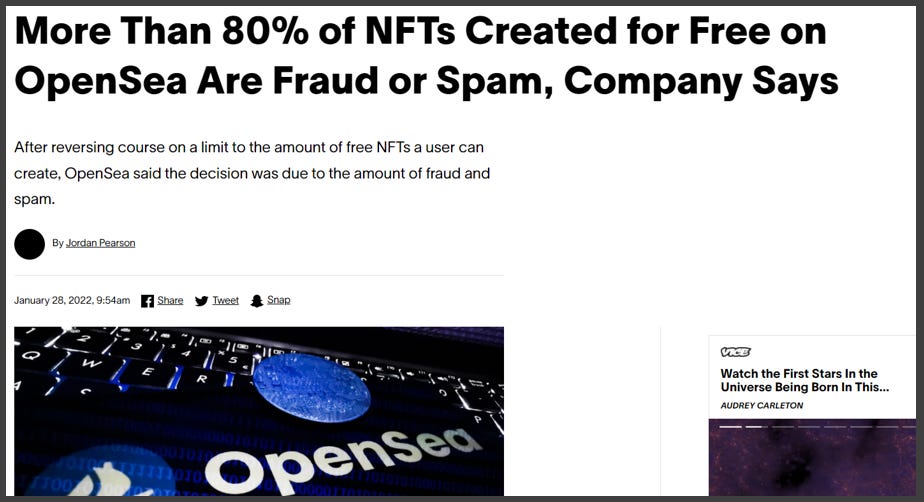

80% of OpenSea’s minted NFTs for free were plagiarized works, fake and spam

Despite this extraordinary growth, there has been growing concerns regarding NFTs sold for free on those NFT marketplaces. In fact, the biggest NFT marketplace, OpenSea, valued at $13.3B after its latest round of venture funding, said earlier in 2022 that more than 80% of the NFTs minted for free on its platform were “plagiarized works, fake collections and spam”.

In an interview with Reuters, Cameron Hejazi, CEO and founders of NFT Marketplace Cent, highlighted three main problems with NFT sold through NFT marketplaces: people selling unauthorised copies of other NFTs, people making NFTs of content which does not belong to them, and people selling sets of NFTs which resemble a security. He said these issues were “rampant”, with users “minting and minting and minting counterfeit digital assets”.

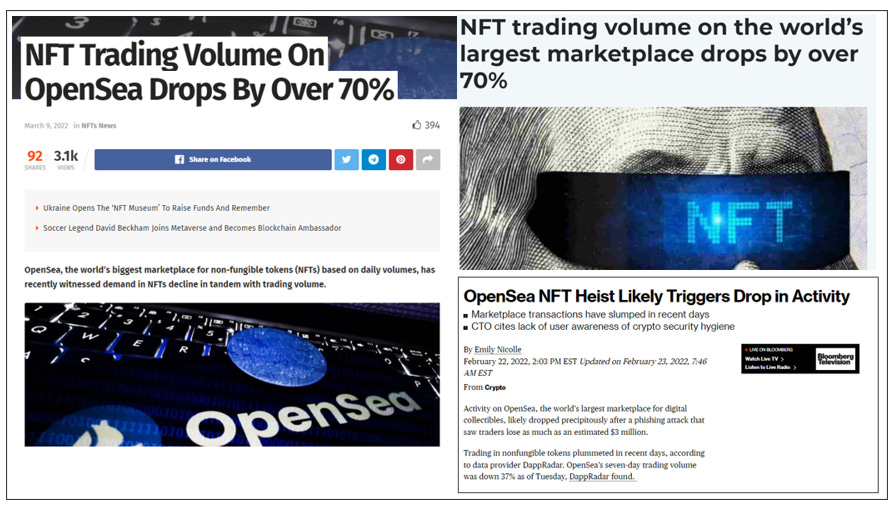

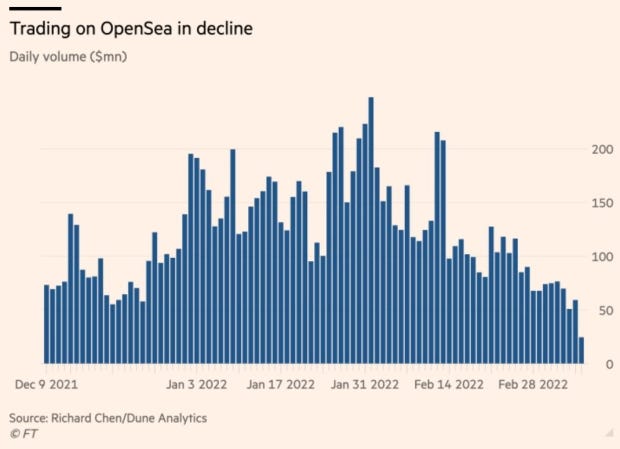

Following OpenSea’s statement, this greatly impacted OpenSea greatly as NFT trading volume on OpenSea, according to FinancialTimes, were down by 80% ($50M) through march 2022 , as opposed to the $284M in trade volume reached in February, triggering what the media calls “the great NFT sell-off”.

Here is a chart illustrating the decline of the daily NFT trading volume on OpenSea from December 2021 to February 2022.

Picture: OpenSea’s NFT trading volume

Biggest issues with most NFT marketplaces: Phishing attacks, Gas/Minting Fees, closed ecosystems.

Generally speaking, there are several issues with NFTs sold on NFT Marketplaces (e.g. OpenSea). We summarized those issues in the following section:

Growing number of phishing attacks targeting NFT marketplaces (e.g. OpenSea) due to the lack of NFT vetting processes

One of the first main issues with some NFT marketplaces like OpenSea is that they do not have a proper vetting system for NFTs, in other words they do not curate and vet NFTs on their marketplace. However, other NFT marketplaces such as Rarible, NBA Top Shot, or Sorare, do curate and vet NFTs sold on their marketplaces.

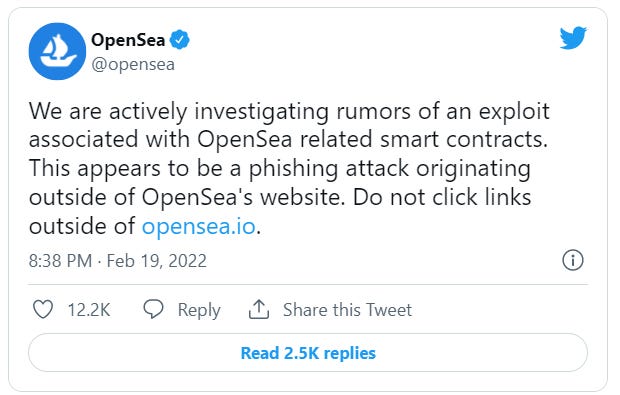

This has had negative consequences for NFT marketplaces like OpenSea which has been the victim of phishing attacks earlier this year. In fact, in February, hackers stole $1.7M worth of NFTs belonging to 17 members of the its marketplace. Back then, a small number of OpenSea users noticed that their NFTs were missing.

About an hour and a half after the NFTs went missing, OpenSea tweeted, as shown below, that, in fact, the phenomenon appeared “to be a phishing attack originating outside of OpenSea’s website.”

OpenSea ended up fixing the issue with a software update but the damage was already done. But again the fact that OpenSea has no vetting system for NFTs, has been a big problem.

But some key industry players such as DaChain a leading tech enabler in the NFT and metaverse space, believe that the recent security incidents impacting NFT marketplaces like OpenSea pose a learning opportunity for the NFT sector. This is what Marco Corradino, DaChain CEO explained during an interview with the Upside: “Security is increasingly becoming a central topic in the world of NFTs. Whilst recent incidents are very unfortunate, they pose a learning opportunity for the sector to improve and rectify. Managing consumer interactions in new, more controlled ways is paramount, starting with a community first approach which by nature should be managed in a transparent and inclusive way”.

That being said NFT marketplaces are starting to take the appropriate measures to improve the vetting systems, which allows them to take down collections in case of frauds. This is what Gerbert Vandenberghe, COO of Venly explained during an interview with the Upside: “There is a lot of spam NFTs and fraudulent NFTs (copies of other collections) as most marketplaces have no or limited curation. All marketplaces have some form of centralization as well, which allows them to take down collections or come in between the NFT sales”.

Lastly, according to Mr Vandenberghe, “contract based marketplaces also have technical issues, like front running transactions, which allows insiders to scoop the best NFT sales”. But Mr Vandenberghe and his team are working on addressing the issue with the future use of advanced algorithms in order to automatically detect fraudulent NFTs and prevent front running transactions.

Most NFT marketplaces are closed ecosystems. Difficult for NFT creators to seamlessly sell NFTs cross platforms. Questions around legal and rights ownership need to be addressed.

To a lesser extend, another big issue with most NFT marketplaces is that there is not a seamless process for NFT creators to sell their NFTs cross platforms in order to maximize revenues. But technically anybody can download NFTs and mint them on other platforms. Generally speaking this issue is slowly being addressed by most players to make it a smoother process for NFT creators.

This is what Marco Corradino, DaChain CEO explained during an interview with the Upside: “From a consumer standpoint the current walled garden set up – i.e. the difficulty to port NFTs from one platform to another – is certainly a minus. It is rapidly being addressed technically, however there are still many unknowns from a legal and rights ownership perspective that will need to be resolved”.

To Mr Corradino’s point, there are still many questions around legal and ownership. In fact, during our recent discussion with some top athletes, some athletes pointed out to us that for many athletes NFTs should be based on unique moments (picture, video of an athlete) captured during sports events (tournaments, championships..). However, for example, in sports like pro golfing, athletes still do not own the rights at the moment.

Fees (Gas, minting fees..) charged by NFT marketplaces

Most NFT marketplaces such as Sorare, OpenSea, Rarible, or NBA Top Shot, also charge various fees (gas fees, minting fees..) when NFT creators sell their NFTs on their marketplaces. This can sometimes be challenging for many NFT creators as it eats into their profit when selling their NFTs. But there is a growing number of NFT marketplaces enabled by companies like DaChain that do not charge those types of fees to NFT creators.

Lack of knowledge towards web 3.0 and hype are other key problems

One of the other problems with some of those NFT marketplaces is the general lack of knowledge from sports organizations towards web 3.0.

“We look at these ‘issues’ from a different angle. We focus on the person or organization that would get hurt, when these unsolved problems spin out of control. So for us, the biggest issue is knowledge. Most people only see the upside, and are unaware of the many holes that still remain. Or, in the world of live sports, are not being told the full story”, explains Sven Van de Perre, Creative Director, Tropos AR, during an interview with the Upside.

Another key problem is the hype surrounding the NFT world and especially some of the NFT startups which are under significant pressure to execute which sometimes leads to short sighted decision.

“That bubble, driven by insane valuations of some NFT companies, who raised insane amount of money and now have 36 months to prove to their new shareholders that their prognostics where accurate. That is the perfect basis for chains of short-sighted decisions”, continues Sven Van de Perre, Creative Director, Tropos AR.

Recommendations for pro teams to adopt an NFT solution, and pick and adopt an NFT marketplace

In this section, and based on insights from thought leaders in the space, we provided recommendations for pro teams to adopt an NFT solution, and pick and adopt an NFT marketplace:

- Look beyond the short term NFT cash grab: This is what Sven Van de Perre, Creative Director, Tropos AR, explained during an interview with the Upside: “As a veteran tech consultant with over 20 years of videogame industry experience, I urge clubs and federations to look beyond the short term NFT cash grab. Many of the current solutions, turn sports footage into speculative investment assets. Goods that are bought and sold by cryptocurrency enthusiasts, who’s affinity with sports is mediocre at best. And completely disregard the actual purpose of sports memorabilia: to be admired and cherished by its owner. In most of the sports NFT market, selling for profit is the only goal. Clubs need to be aware that the Crypto crowd will leave, once a more profitable option presents itself. And their real fans could be left holding over-valued assets. And if that happens, the collateral damage to the club and the sports will be immense. So many NFT start-ups raised funds at insane valuation. And are now forced to to turn those promises into reality, by any means necessary. That is not a solid base to build a balanced ecosystem”.

- Focus on NFTs to improve fan engagement, and collect digital sports memorabilia, and connect them to other digital fan engagement tools: This is what Sven Van de Perre, Creative Director, Tropos AR, explained during an interview with the Upside: “Clubs and federations should seek out those NFT solutions that have originated from within the world of sports. And that focus on fan engagement, collecting and admiring digital sports memorabilia, and connecting it to other digital fan engagement tools. Like all other things, love for the sport should be placed front and center. In the short, and in the long term”.

- Adopt NFT marketplaces where NFTs are vetted for authenticity and ownership before being loaded: It is important for teams to work with NFT marketplaces or tech enablers like DaChain where NFTs are truly vetted for ownership before being loaded and sold. “DaChain is a new NFT platform that gives brands new ways to interact with their customers, creating engaging and fun new ecosystems to build loyalty and engagements. Helping to build the ultimate fandom. We take a curated / verified first approach, meaning that all our content is vetted for authenticity and ownership before being loaded. We take a consumer first approach which applies to our state-of-the-art security standards too. ”, explains Marco Corradino, DaChain CEO, during an interview with the Upside.

- Be informed on the blockchain technology, its pros and cons and the ecosystems of the different blockchains. It is also important for sports organizations to fully understand blockchain technologies as well as its pros and cons. They differ in terms of speed, transaction costs and security. Some have a large engaged community and others fake their traction.

- Allocate a good portion of your budget for fans education and communication: Like any new technologies it is sometimes difficult for sports organizations to fully understand new technologies. In this particular case, sports organizations should allocate a good portion of their NFT budget to educate their fans on how to properly use NFTs. This could be done via a variety of ways such as webinars, white papers, educational videos, etc. The education part is critical here. It will help sports organizations successfully launch their NFT solutions.

- Design your NFTs with marketplaces and wallets in mind. It goes back to offering NFT solutions with the best user experience. In this case, making marketplaces and wallets key components of the NFT buying experience should be top of mind for any teams looking to launch an NFT solution. This is where working with companies like DaChain or Venly to offer a white label wallet and market place is critical.

- Offer a differentiated NFT experience that create new communities on Discord and web 3.0 platforms, with unique and engaging experiences (e.g. AR experience with gamification engine): It is critical for teams to focus on offering differentiated NFT experiences that will increase fans engagement. One of the ways to provide such experience is through the use of AR with gamification and rewards mechanisms. Sports organizations should work with companies like DaChain and Tropos AR to build such experiences. ““Our approach brings together a strong consumer front end, with sophisticated tools for analytics and advanced marketing as well as a bridge to create new communities on Discord and other web 3 agoras. Our Augmented reality and Gaming capabilities give brands excellent opportunities to bring NFTs into real life, giving their customers and fans tangible utility and benefits. DaChain is the technology enabler for brands to create the ultimate web 3 fandom”, explains Marco Corradino, DaChain CEO, during an interview with the Upside.

- Don’t forget legal. It is important for any sports organizations looking to launch an NFT solution to remember that all blockchain based assets are getting regulated. This is not only the case for cryptocurrencies. Therefore it it critical for sports organizations to consult with their legal department or legal experts in order to properly implement their NFT solution.

- Do not base your decision to pick an NFT vendor only based on the NFT vendor’s guaranteed minimums: As a sports organization looking to pick an NFT vendor, picking a vendor primarily based on the guaranteed minimums alone provided by the NFT vendor, is unlikely to be a good strategy for sports organizations. Based on our sources, some NFT vendors are willing to pay sports organizations as much as $500k to secure deals. Instead, sports organizations should pick NFT vendors based on a variety of factors (e.g. environmental impact, business model, customer support..).

Bottom line: There is no question that the NFT space is booming. Sports organizations want to bank on this opportunity. Now we believe that over time some of the issues (e.g. phishing attacks, closed ecosystems, legal and rights ownership…) experienced by NFT marketplaces will be addressed. Some of these issues will be resolved faster than others. From a content creator point of view, we also believe that athletes should be in control of their content and own their content in order to be able to create and sell their own NFTs. Ultimately NFTs, coupled with unique metaverse experiences, will enable sports organizations and athletes to create new types of experiences for fans. It will also create new revenue opportunities for sports organizations and athletes. Ultimately it will be a win win situation for all parties.

Leave A Comment

You must be logged in to post a comment.