Over the past 3 months, the Metaverse has become the new buzzword in the tech world with literally every single tech company announcing a Metaverse strategy. On top of that, major brands (Nike, Disney…) are now making inroads into the Metaverse space. Facebook, which renamed itself as Meta, is also making a big bet into the space. Some experts now claim that the Metaverse space is set to become a 1 trillion dollars market. But is the Metaverse really something new or just AR+VR+MR combined with NFTs, social networks and super maps? Do those companies really have a solid Metaverse strategy and business model? In this analysis on the Metaverse ecosystem we will discuss the megatrends, the challenges and drivers, the Metaverse ecosystem as well as our recommendations to pro teams and leagues to adopt a successful Metaverse strategy.

Metaverse: Megatrends

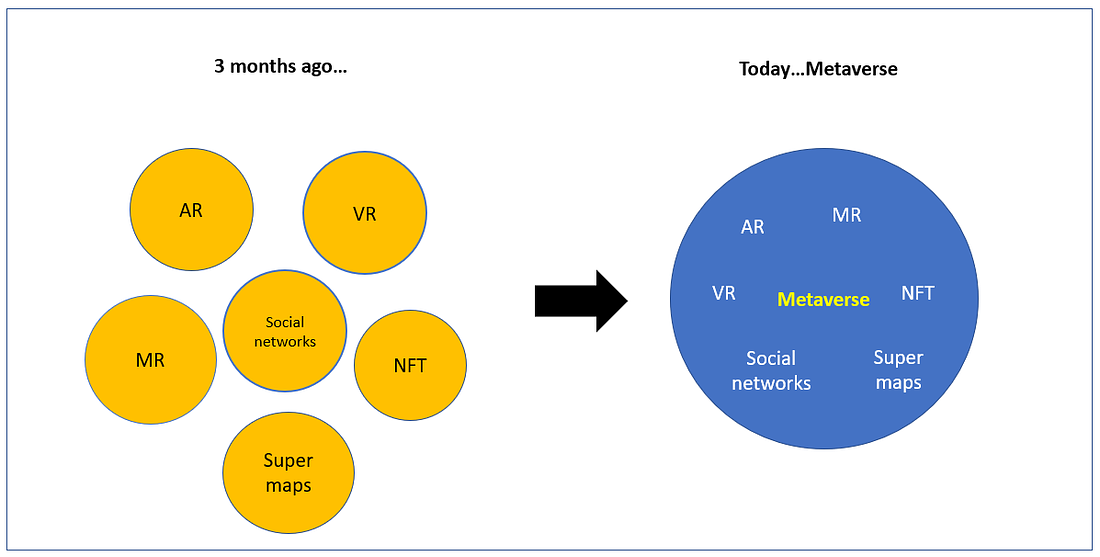

Is the Metaverse really something new or just AR+VR+MR now combined with super maps, social networks and NFTs?

Ever since Facebook changed its name to Meta every single tech startups in AR, VR, NFTs have jumped on the Metaverse bandwagon, claiming to have a Metaverse strategy. We are now seeing some AR and VR pivoting and calling themselves a Metaverse startup while NFTs startups are now claiming to have a Metaverse strategy. Some of these startups are even going as far as changing their company name to include the term “Verse” in their new company name as part of their pivot strategy. For example, major brands such as Nike are now hiring Metaverse designers and a head of Metaverse strategy. Disney, which plans to integrate a personalized storytelling to create a “theme park metaverse, already announced that Disney+ would be at the center of its Metaverse strategies.

Here is a typical example of a big brand (Nike) getting into the Metaverse space with Fortnite.

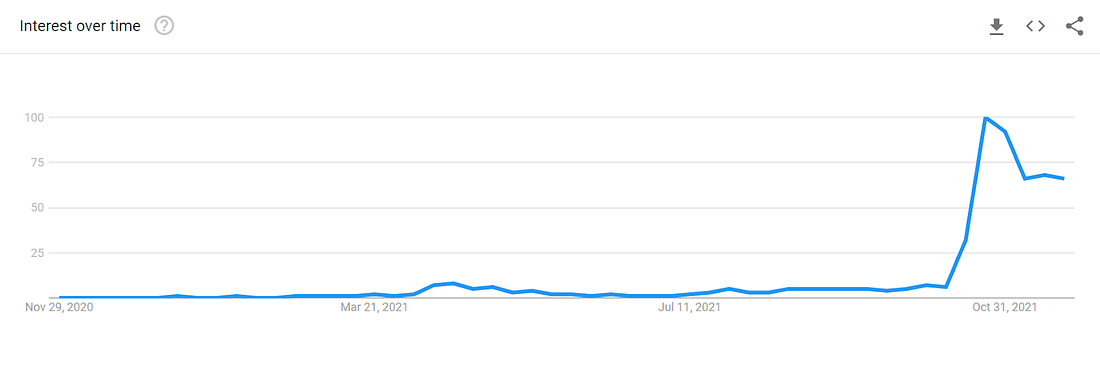

Not surprisingly, as shown in the Google Trend graph below, Metaverse has become one of the most talked and searched about words in the tech world.

Source: Google Trends, search for Metaverse keyword on google, Upside, December 2021.

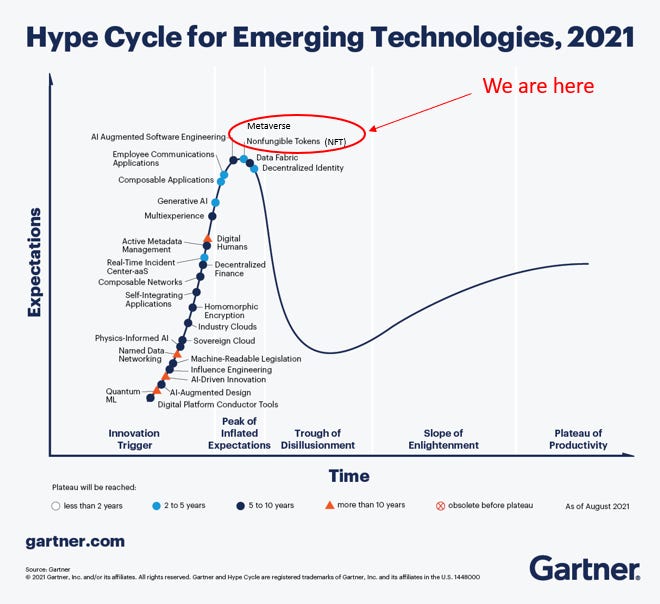

Based on the Gartner Hype cycle chart below, we believe that the Metaverse is currently in the “hype “phase based on all the excitement surrounding the space with literally every single major tech companies and brands announcing their Metaverse strategy on a weekly basis.

But is the Metaverse a new concept? We believe that Metaverse is not something new but essentially AR, VR, MR now combined with NFTs, social networks and super maps. As shown in the graph below, it is not a new concept, far from it. We believe that it is a marketing tactic used by the big tech companies (Facebook..), big brands (Nike..), gaming companies (Roblox..), and startups, to try to create some new excitement in the tech world, in order to further drive their top line.

Source: Metaverse ecosystem, Upside Global, December 2021.

Some experts believe that in a way there were already metaverse platforms out there such as Roblox or Gen Aphas, just to name a few. For example, big brands already offer Gen Alphas the opportunity to buy Nike, Adidas and Under Armour-branded “skins” for their characters inside these digital worlds.

Majority of sports tech companies are entering the Metaverse market, but do they all have a solid business & strategy? A few do. Mostly do not.

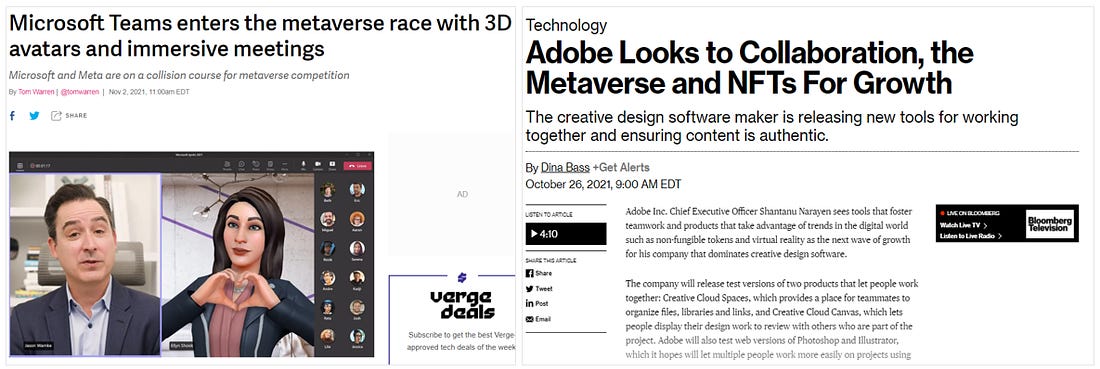

Ever since Facebook renamed itself to Meta literally every single major tech company, brands have started to announce their Metaverse initiatives. For example, Microsoft is entering the race to build a metaverse inside Teams, just days after Facebook rebranded to Meta in a push to build virtual spaces for both consumers and businesses. Microsoft is bringing Mesh, a collaborative platform for virtual experiences, directly into Microsoft Teams next year. It’s part of a big effort to combine the company’s mixed reality and HoloLens work with meetings and video calls that anyone can participate in thanks to animated avatars. Adobe also announced new tools to enable content creators to create NFTs and metaverse content.

But with literally every single AR, VR, NFT companies and big brands (Nike, Disney..) claiming to have a Metaverse strategy, we have to wonder if all these companies have a tangible business model. Some do but many do not. Why? Because we are in the early days of the Metaverse. Quite frankly if some of these startups did not have a successful and solid business model or strategy before this whole Metaverse phenomenon how can they pretend to have a solid business model or strategy now? We highly doubt it. Plus the level of competition in the metaverse space has become extremely high where some of these startups now have to compete against tech giants such as Facebook, Apple, Microsoft, Samsung, Nike, Disney, and many more.

The Facebook effect…Until Apple changes the game.

Facebook, by changing its name to Meta, brought a lot of attention to the Metaverse universe. Some even argue that Facebook is at the core of the Metaverse. But we believe that the Metaverse space will really take shape when Apple officially enters the Metaverse race. And as we know, Apple is in no rush to jump on the Metaverse bandwagon. They will do what they always do: Wait until most of its competitors unveil their Metaverse strategy, and then they will try to address most issues and come up with a slick product with a tight software/HW integration. We expect Apple’s upcoming hybrid AR/VR glasses coupled with Apple’s Apple Maps to be at the core of Apple’s Metaverse strategy. However, unlike Facebook/Meta, Apple does not have a social networks..and this is where Facebook’s advantage will be. But as soon as Apple unveils its Metaverse product and strategy, all the other OEMs (Samsung, Microsoft, Facebook..) will follow and try to match Apple’s metaverse experience.

M&As activities around the Metaverse are accelerating

We are also seeing M&As accelerating in the Metaverse space as tech companies are making big bets to acquire technologies that will enable them to get an edge over the competition and be at the core of the Metaverse space. For example, Unity geared up for the Metaverse by announcing its plan to acquire Peter Jackson’s VFX studio, Weta Digital, for over $1.62 billion in cash and stock. That move is intended to bolster Unity’s toolset and talent for 3D content creation as it jumps on the metaverse bandwagon.

We expect this M&A phenomenon to accelerate in the coming months with major tech companies such as Apple, Google, Facebook, Amazon, Nike, to name a few, going on an M&A spree in order to enhance their Metaverse strategy, and get a competitive advantage.

Fragmentation is set to become a major issue with the emergence of not one but multiple metaverse ecosystems

Nike teamed up with Roblox. Adidas also teamed up with Cointbase as part of its Metaverse push. The Bros launched a $400M metaverse fund to compete with Meta/Facebook. Samsung Electronics Co. has onboarded South Korea’s government-led metaverse alliance in a move to strengthen partnership in virtual reality (VR), augmented reality (AR) and artificial intelligence (AI) sectors.

According to the Ministry of Science and ICT (MSIT) on Aug. 3, a total of 202 firms are participating in the metaverse alliance with a number of new joiners that include Samsung. Other companies that have newly joined the alliance include Shinhan Bank, KB Kookmin Bank, SM Entertainment Co., MegaStudyEdu Co. and Cheil Worldwide. With that in mind we expect to see the emergence of not one but many competing metaverse ecosystems.

At the end of the day, we don’t believe that the major tech companies (Apple, Facebook, Microsoft, Samsung, Google…) have any plans to play nice with each other. In fact, we believe that they will try to create their own metaverse ecosystems, which is what some vendors are (Facebook, Microsoft, Nike…) already doing. This is set to become a major headache for developers trying to build metaverse apps for those ecosystems. Similar to what happened with Android with OEMs and big tech companies trying to create their own forged version of Android, Metaverse developers will have to create custom versions of their metaverse apps for each of those metaverse ecosystems which will cost them time and money.

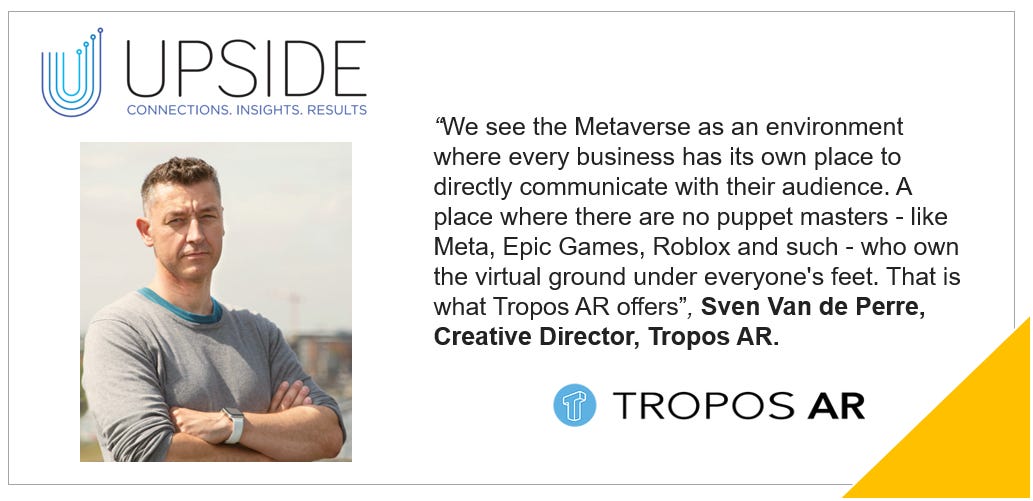

This is why some metaverse startups like Tropos AR want to provide an alternative to the big metaverses created by Meta, Roblox and others. This is what Sven Van de Perre, creative director at Tropos AR, recently explained to us during an interview: “We see the Metaverse as an environment where every business has its own place to directly communicate with their audience. A place where there are no puppet masters – like Meta, Epic Games, Roblox and such – who own the virtual ground under everyone’s feet. That is what Tropos AR offers”.

Increasing number of VCs investing into Metaverse startups

Not surprisingly VCs are now focused on Metaverse startups which are essentially AR, VR, MR, NFTs/blockchain startups. As a result of that investments towards metaverse startups has been on the rise. In fact, according to Crunchbase, companies related to the metaverse (tagged under gaming, online games, virtual worlds, and augmented reality) have raised nearly $10.4B so far this year across 612 deals, Crunchbase data shows, with Epic Games’ $1 funding round in April 2021 leading the pack.

That’s a significant jump from the $5.9B companies tagged in those categories raised last year, and by far the most amount raised for the broader “metaverse category” in a single year in the last decade.

Funding this year broadly breaks down into four big categories:

- Gaming: about $7.5B (382 rounds)

- Online Games: about $2.5B (110 rounds)

- Augmented Reality: about $2.1B (176 rounds)

- Virtual world: $62.8M (9 rounds)

Keep in mind when looking at this breakdown that some companies are tagged under multiple categories. NFTs startup unicorns such as Sorare and Dapper Labs, which have now raised $600M+ and $400M+ to date, which fall under the Metaverse ecosystem, recently benefited from this trend as part of their last round of financing.

We expect VCs to continue to heavily focus on Metaverse startups in the next 24 months to try to find the next Metaverse startup unicorn.

Is the Metaverse market really worth 1 Trillion dollars? It is too soon to tell. The Combined Market Cap of web 2.0 companies is $15 Trillion today.

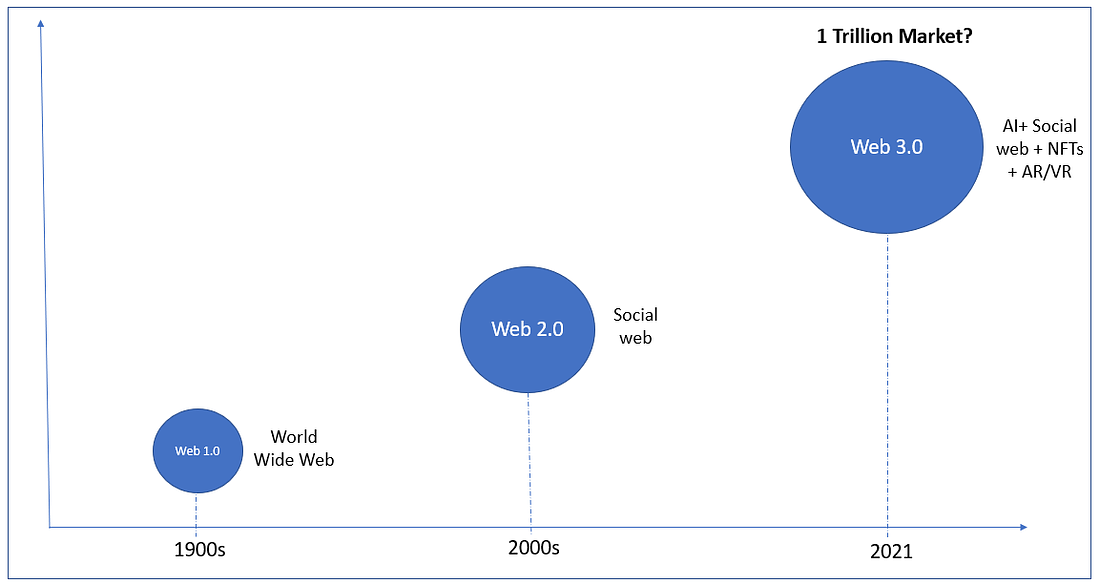

In the 1990s we had Web 1.0, which refers to the first stage of the World Wide Web evolution. Then in the 2000s we had web 2.0, which refers to worldwide websites which highlight user-generated content, usability, and interoperability for end users. Web 2.0 is also called the participative social web.

Source: Metaverse ecosystem, Upside Global, December 2021.

Today we are seeing the emergence of web 3.0. It refers to the evolution of web utilization and interaction which includes altering the Web into a database. It enables the up-gradation of the back-end of the web, after a long time of focus on the front-end (Web 2.0 has mainly been about AJAX, tagging, and another front-end user-experience innovation). Key components of web 3.0 includes semantic web, AI, 3D graphics, ubiquity and connectivity. The metaverse is part of this web 3.0 revolution as it includes elements such as AI, 3D graphics, and so on.

Source: GeeksforGeeks.org, 2021

So how much is the Metaverse market actually worth? The Metaverse is the next trillion dollars opportunity, according to a report published by the digital asset management firm, Grayscale. The report added that the Metaverse has the potential to compete with Web 2.0 companies. Epic Games CEO also said that it could be the next trillion economy.

In terms of growth, the total number of Web 2.0 Metaverse virtual world users crossed 50,000 this year, which is up by 10x compared to the start of 2020. Despite the rapid growth, the virtual world is still at an early stage.

Additionally, the report outlined the importance of Web 3.0 crypto Metaverses. According to Grayscale, the total market cap of Web 3.0 Metaverse crypto networks stands at around $27.5 billion, compared to the $15 trillion market cap of Web 2.0 companies.

However none of them indicated the timeline, in other words, how long it will take for the metaverse market to reach such milestone. Will it take 5 years? 10 years? No one knows at this point. This is way too early to tell.

NFTs for sports expected to generate $2B in transactions in 2022, with 4-5M sports fans expected to purchase or been gifted NFT sports collectibles.

Deloitte Global predicts that NFTs for sports media will generate more than $2B in transactions in 2022, about double the figure for 2021. By the end of 2022, Deloitte expect that 4–5M sports fans globally will have purchased or been gifted an NFT sports collectible. Interest in sports NFTs is likely to be spurred by activity in the wider NFT market, including that for digital art, the top five most valuable sales of which had generated over $100M by August 2021.

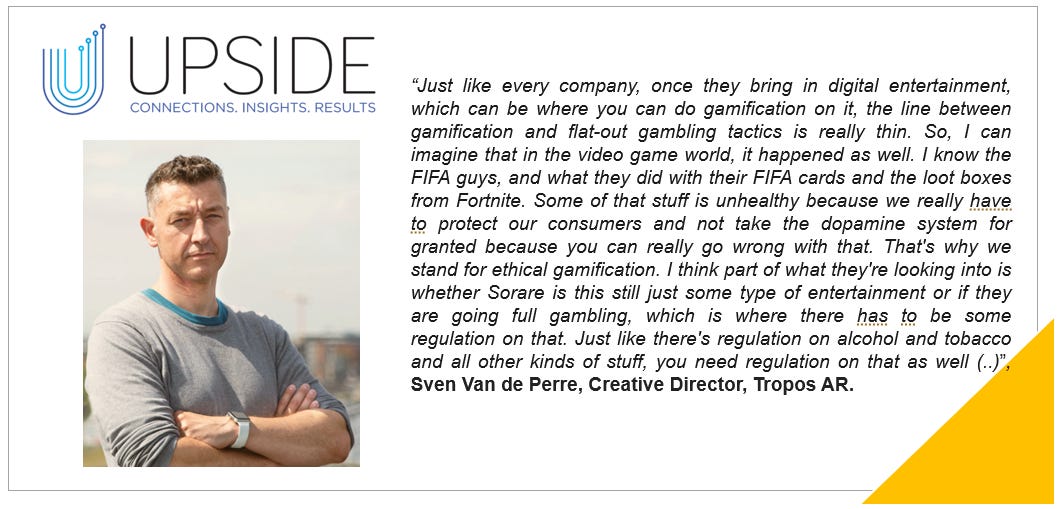

But gambling regulators could impact the growth of the Metaverse Market

Gambling regulators are likely to negatively impact the growth of the metaverse market as we expect those regulators to try to regulate NFTs vendors. In fact as we previously mentioned, Sorare was recently in the news as the UK gambling regulator is asking them to get a gambling license in order to operate their business. Some metaverse startups actually believe that regulation is a good thing in the NFT space. This is what Sven Van de Perre, creative director at Tropos AR, recently explained to The Upside during a podcast interview:

“Just like every company, once they bring in digital entertainment, which can be where you can do gamification on it, the line between gamification and flat out gambling tactics is really thin. So I can imagine that in the video game world, it happened as well. I know the FIFA guys, and what they did with their FIFA cards and the loot boxes from Fortnite. Some of that stuff is unhealthy because we really have to protect our consumers and not take the dopamine system for granted because you can really go wrong with that. That’s why we stand for ethical gamification. I think part of what they’re looking into is whether Sorare is this still just some type of entertainment or if they are going full gambling, which is where there has to be some regulation on that. Just like there’s regulation on alcohol and tobacco and all other kinds of stuff, you need regulation on that as well”.

The Metaverse bubble likely to burst in the next 24 months

We expect the metaverse bubble to burst in the next 24 months. Why? Because there are a myriad of metaverse startups that do not have a solid business model or any business model at all. Many of these startups will end up shutting down. On top of that, we expect to see increased pressure from VC / investors on some of the NFT startups unicorns to execute, win lots of deals and generate revenue in a big way. If some of those unicorn startup CEOs do not reach those milestones quickly things could go south fast for some of those startups with VCs and investors making changes within the leadership team to shake things up. Now just to be clear: We are wishing all the best to all these NFT and metaverse startups CEOs and we hope that they execute well and meet their goals. That’s all we can hope for these startups. Also in the sports arena, a number of NFT vendors (e.g. Dapper Labs, etc..) are signing deals at the league level (NBA, NFL, etc..) which will make it extremely difficult for small startups to get into certain leagues and generate revenue in a big way. This will force those smaller startups to be more creative and target other leagues.

What is the Metaverse killer use case? Too soon to tell

What will be the killer metaverse user case(s)? In our view it is too soon to tell. We know what the key components (AR, VR, Social networks, NFTs…) of the metaverse experience will be, but only time will tell what metaverse experience resonates with brands and end users.

Now there are already some metaverse startups that have built some metaverse experiences. One of them is Dream VR, which developed Dream LIFE VR, a decentralized metaverse hosted on blockchain under the Ethereum protocol. This Virtual Universe will initially be composed of 12 cities and will be offering +300 experiences located in advertising supports at the central square of each city. Furthermore, the Dream LIFE VR will offer VR games for those who love gaming. Other features will come along.

This is what Albert Palay, CEO of Dream VR., recently explained to The Upside during an interview: “We are facing with the possibilities that virtual reality gives us to create habitable universes beyond the physical world. A Metaverse is a platform and/or interface that we will use more and more to simulate presence, meet people and live experiences. In short, it is a set of spaces in which to live all kind of virtual experiences (..) Metaverse is the convergence of the real and virtual world in a persistent way and shared between all parts; the 3D internet. All creative areas that make up this digital environment tend to benefit from programming and modelling in 3D, design, user experience, art direction, writing, the storytelling and gamification. In short, all in one”.

Video: Dream VR’s metaverse experience

Moving forward, we believe that this is the kind of metaverse experiences that we are likely to see more and more in the coming years.

Metaverse Sports vendors ecosystem: From Metaverse Discovery tools…to Metaverse creators tools

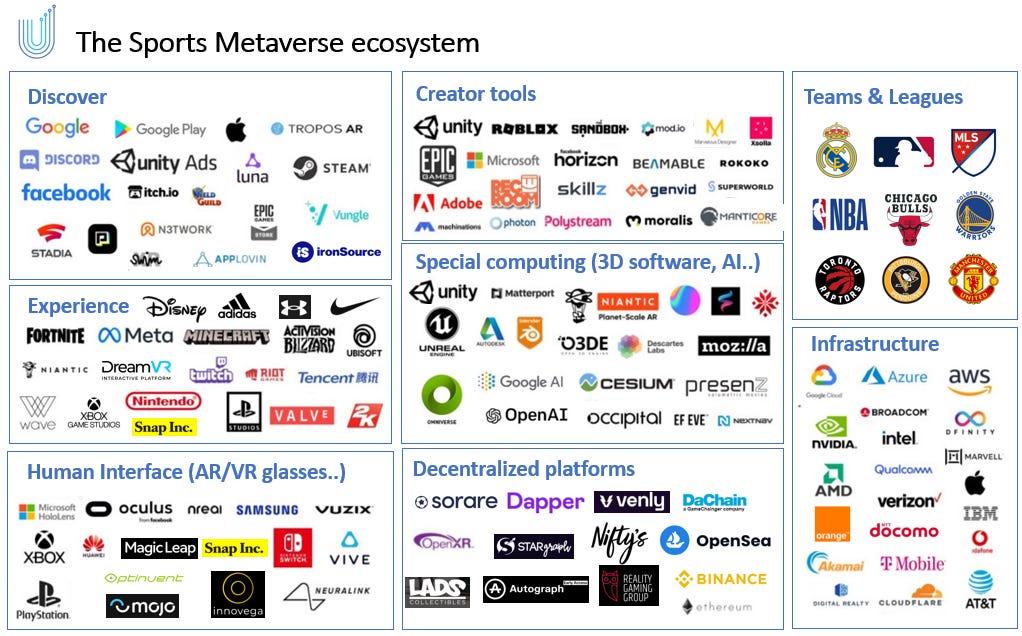

The Metaverse sports market is comprised of various subsegments that can be summarized as follow:

- Discover refers to how users learn and get access to the various Metaverse experiences (Metaverse apps..). Companies that fall into this category includes companies such as Google, Google Play, Discord, Stadia, Unity Ads, Steam, Tropos AR, just to name a few.

- Experience typically refers to the types of metaverse experiences that users interact with. This could be a game, live music, social experience etc. Metaverse vendors that falls into this category includes companies such as Nike, adidas, Fortnite, Meta, Minecraft, Activision, Ubisoft, Twitch, Dream VR, Niantic, Tencent, Playstation, Nintendo, Valve, 2K, just to name a few.

- Human interfaces usually refers to the types of hardware (AR/VR glasses, contact lenses, advanced haptics, etc..) used to experience the Metaverse. Vendors specialized in this category includes companies such as Microsoft (Hololens), Oculus/Meta, nreal, Optinvent, Xbox, Huawei, Mojo Vision, Vive, Apple, Samsung, Vuzix, Emacula, Snap, etc.

- Creator tools are typically tools that help creators build and monetize things for the Metaverse. Those includes design tools, wallets, animation systems (3D..). Companies that fall into this category include vendors such as Unity, Roblox, Epic, Microsoft, Adobe, Horizon, Rokoko, just to name a few.

- Special computing usually refers to software (Gesture recognition, 3D engines, 3D maps, AI..) that helps transform objects into 3D animations, and enable Metaverse users to interact with them. Vendors that fall into this category include companies such as Unity, Matterport, Niantic, Unreal, OpenAI, Occipital, Autodesk, just to name a few.

- Decentralized platforms refers to platforms that are no longer part of an ecosystem but are instead distributed and decentralized. Under this categories there are some subsegments that are critical to the world of NFTs such as:

- Metaverse creators: Typically NFT creators are companies that enable sports organizations (clubs, leagues..) to offer and sell their own NFTs to their fans. Those include companies such as MyLads, STARGraph, just to name a few.

- End users NFT product vendors (e.g. Games): These are NFT vendors who offer sports organizations an NFT platform which enable them to create end user NFT products (e.g. games, etc.) and sell their own NFTs (e.g. players trading cards..) to their fans. Those include companies such as Sorare, Geer, Fantastec, Illuvium, Rage Fan, Dapper Labs, Unblockable.

- Marketplaces: Typically NFT market places vendors enable teams, athletes to sell their NFTs to their fans. Those include companies such as Crypto.com, Binance, FTX, Autograph, Open Sea, Reality Gaming Group, STARgraph, or Venly.

- Tech enablers & analytics companies: These are companies who typically provide the tools to NFT creators to create NFTs for their customers (clubs, agencies..). Simply put these are technology enablers for NFT creators. The types of tools that these company usually offer are blockchain wallets, NFT management/creation solutions, NFT marketplace, and/or NFT API with deep analytics. Companies such as Venly or Dachain.io are among the top vendors in this NFT segment. Other companies such as OTM offers deep analytics and consulting services as well.

- Infrastructure refers to infrastructure components (Cloud, telecommunication networks, semiconductors/chips, etc..) to help create and connect the Metaverse experiences. Companies that fall into this category includes companies such as Google (Cloud), Microsoft (Azure), Amazon (AWS), Nvidia, Intel, Broadcom, AMD, IBM, Verizon, AT&T, T-Mobile, Orange, just to name a few.

Source: Upside Global, Confidential, December 2021.

In this next section, we will highlight some of the major Metaverse vendors and their respective strategies in the market. Please note that this list of vendors is not meant to be all inclusive.

Key Metaverse Vendors

A. Big tech/OEMs:

- Facebook/Meta

Founded: 2004

HQ: Menlo Park, CA (USA)

Amount money raised: Public company

Website: www.meta.com

Investors: Accel Partners, Greylock Partners, Peter Thiel.

Total employees: 58,604

Metaverse products: AR/VR (Oculus, Ray-Ban Stories Glasses), Metaverse platform

Company’s background: Meta is a social technology company that enables people to connect, find communities, and grow businesses. Previously known as Facebook, Mark Zuckerberg announced the company rebrand to Meta on October 28, 2021 at the company’s annual Connect Conference. Facebook was founded by Mark Zuckerberg in Menlo Park, California in 2004. With millions of more users, [Friendster] attempted to acquire the company for $10 million in mid-2004. Facebook turned down the offer and subsequently received $12.7 million in funding from [Accel Partners] at a valuation of around $100 million. Facebook continued to grow opening up to high school students in September 2005 and adding a photo-sharing feature the next month. The next spring, Facebook received $25 million in funding from [Greylock Partners] and [Meritech Capital] as well as previous investors [Accel Partners] and [Peter Thiel]. The pre-money valuation for this deal was about $525 million. Facebook subsequently opened up to work networks eventually amassing over 20,000 work networks. Finally, in September 2006, Facebook was opened to anyone with an email address. In 2021, Facebook launched a $50M fund dedicated to invest in Metaverse startups.

- Microsoft

Founded: 1975

HQ: Redmond, WA (USA)

Amount money raised: $1M initially, now a public company

Website: www.microsoft.com

Investors: Technology Venture Investors

Total employees: 182,268

Metaverse products: Xbox, Minecraft, Hololens, Mesh (Collaborative platform built into Microsoft Teams).

Company’s background: Microsoft is an American multinational corporation that develops, manufactures, licenses, supports, and sells a range of software products and services.

Microsoft’s devices and consumer (D&C) licensing segment license Windows operating system and related software; Microsoft Office for consumers; and Windows Phone operating system. The company’s computing and gaming hardware segment provides Xbox gaming and entertainment consoles and accessories, second-party and third-party video games, and Xbox Live subscriptions; surface devices and accessories; and Microsoft PC accessories. Its phone hardware segment offers Lumia smartphones and other non-Lumia phones. Its D&C other segment provides Windows Store, Xbox Live transactions, and Windows phone store; search advertising; display advertising; Office 365 Home and Office 365 Personal; first-party video games; and other consumer products and services as well as operating retail stores.

The company markets and distributes its products through original equipment manufacturers, distributors, and resellers, as well as online. Microsoft Corporation was founded by Bill Gates and Paul Allen in 1974. It is based in Redmond, Washington.

- Samsung Electronics

Founded: 1969

HQ: Seoul (South Korea)

Amount money raised: Public company

Website: www.samsung.com

Investors: Samsung Electronics has raised a total of $747.5M across 2 funds, their latest being Samsung Automotive Innovation Fund. This fund was announced on Sep 14, 2017 and raised a total of $300M.

Total employees: 287,439

Metaverse products: TBD

Company’s background: Samsung Electronics is a South Korean multinational electronics company engaged in consumer electronics, information technology and mobile communications, and device solutions businesses worldwide. The company develops, manufactures, and sells various consumer products, including mobile phones, tablets, televisions, Blu-ray players, DVD players, home theater systems, digital cameras, and camcorders; home appliances such as refrigerators, air conditioners, washing machines, ovens, and dishwashers; PCs, peripherals, and printers comprising tablet PCs, notebooks, monitors, optical disc drives, printers, and computers; memory and storage products such as solid state drives and memory cards; and accessories. Samsung Asset Management, South Korea’s biggest asset manager, has launched a fund tied to a virtual world known as the metaverse. The Samsung Global Metaverse fund is the second metaverse-themed fund to come to market in the country following KB Asset Management’s KB Global Metaverse Economy fund, which launched on June 14 and has attracted around US$4.8 million of investment.

Samsung Electronics was founded in 1969 as a subsidiary of Samsung Group and is headquartered in Suwon, South Korea.

- Apple

Founded: 1984

HQ: Cupertino, CA (USA)

Amount money raised: Public company

Website: www.apple.com

Investors: Apple is funded by 6 investors: Sequoia Capital, Venrock, Matrix Partners. Berkshire Hathaway and Microsoft.

Total employees: 147,000

Metaverse products: ARkit, rumored upcoming hybrid AR/VR headsets

Company’s background: Apple is a multinational corporation that designs, manufactures, and markets mobile communication and media devices, personal computers, portable digital music players, and sells a variety of related software, services, peripherals, networking solutions, and third-party digital content and applications. Apple provides many products and services, including iPhone; iPad; iPod; Mac; Apple TV; a portfolio of consumer and professional software applications; the iOS and OS X operating systems; iCloud; and accessories, service, and support offerings.

Introduced in 1984, the Macintosh was the first widely sold personal computer with a graphical user interface (GUI). That feature and others such as an improved floppy drive design and a low-cost hard drive that made data retrieval faster helped Apple cultivate a reputation for innovation. The company was founded by Steven Paul Jobs, Steve Wozniak, and Ronald Gerald Wayne on April 1, 1976, and is headquartered in Cupertino, California.

- Snap

Founded: 2011

HQ: Venice, CA (USA)

Amount money raised: Public company

Website: www.snap.com

Investors: Snap is funded by 38 investors. Alwaleed Bin Talal and Tencent are the most recent investors.

Total employees: 3,863

Metaverse products: Smart glasses (Spectacles 1, Spectacles 2), AR glass, Mobile AR (Lens)

Company’s background: Snap is a privately-owned multinational camera company focusing on multinational technology and social media. Snap is behind Snapchat, a photo messaging app that allows users to take photos, record videos, add text and drawings, and send them to recipients. In 2016, it released Spectacles, video-sharing sunglasses that free the Snapchat app from smartphone cameras.

- Alphabet / Google

Founded: 1998

HQ: Mountain View, CA (USA)

Amount money raised: Public company

Website: www.google.com

Investors: Google initially raised a total of $36.1M in funding over 4 rounds.

Total employees: 150,028

Metaverse products: AR glasses (Google Glass), ARCore

Company’s background: Alphabet is a holding company that provides projects with resources, freedom, and focus to make their ideas happen. Alphabet is the holding company for Google and several Google entities, including Google X, Google Ventures, Google Capital, Calico, and its Life Sciences efforts. The company’s CEO, Larry Page announced the operational restructuring effort for Alphabet Inc. to replace Google Inc. as the official publicly-traded entity. He announced that all shares of Google would automatically convert into the same number of shares of Alphabet, with all of the same rights. The two classes of shares will continue to trade on Nasdaq as GOOGL and GOOG. It was established in Mountain View, California in 2015 by Larry Page and Sergey Brin.

B. Gaming companies:

- Roblox

Founded: 2004

HQ: San Mateo, CA (USA)

Amount money raised: Public company

Website: www.roblox.com

Investors: Roblox has raised a total of $856.7M in funding over 10 rounds. Their latest funding was raised on Jan 6, 2021 from a Series H round.

Total employees: 1,234

Metaverse products: Roblox gaming platform

Company’s background: Roblox is an online gaming and entertainment platform for a shared digital experience that brings people together through play. It enables anyone to imagine, create, and have fun with friends as they explore interactive 3D experiences produced by developers using their desktop design tool, Roblox Studio. The company is backed by Altimeter Capital, Dragoneer Investment Group, Investment Group of Santa Barbara, and Warner Music Group. The San Mateo, California-based company was established by Erik Cassel and David Baszucki in 2004.

- Epic Games

Founded: 1991

HQ: Cary, North Carolina (USA)

Amount money raised: Public company

Website: www.epicgames.com

Investors: Epic Games has raised a total of $5.1B in funding over 10 rounds. Their latest funding was raised on Apr 13, 2021 from a Venture – Series Unknown round. Epic Games is funded by 36 investors. GIC and Sony are the most recent investors.

Total employees: 1,000+

Metaverse products: Games (e.g. Fortnite). Partnerships with big brands such as Nike and others.

Company’s background: Epic Games is an American video game and software company that creates games and offers its game engine technology to other developers. It specializes in developing games, engine technology and operates a game store that empowers others to make quality games and 3D content, thereby providing game developers the ability to build high-fidelity, interactive experiences for PC, console, mobile, and virtual reality devices. It was founded in 1991 and is headquartered in Cary, North Carolina.

- Electronic Arts (EA)

Founded: 1982

HQ: Redwood City, CA (USA)

Amount money raised: Public company

Website: www.ea.com

Investors: Electronic Arts has raised a total of $2.2M in funding over 3 rounds. Their latest funding was raised on Jan 1, 2019 from a Post-IPO Equity round. Electronic Arts is funded by 5 investors. TCV and Sequoia Capital are the most recent investors.

Total employees: 9,800

Metaverse products: Games (e.g. FIFA, Battlefield..)

Company’s background: Electronic Arts (EA) is a global interactive entertainment software company that delivers games, content, and online services for internet-connected consoles, personal computers, mobile phones, and tablets. The company develops and publishes video games for various platforms, including PC, Xbox One, PlayStation 4, Xbox 360, PlayStation 3, Wii, iPhone, iPad, Android, and Windows Phone. Some of its popular games include The Sims, Madden NFL, EA SPORTS FIFA, Battlefield, Dragon Age, Plants vs. Zombies, Need for Speed, Battlefield, and Mass Effect. Electronic Arts was founded in 1982 and is based in Redwood City, California.

- Unity Technologies

Founded: 2004

HQ: San Francisco, CA (USA)

Amount money raised: Public company

Website: www.unity.com

Investors: Unity Technologies has raised a total of $1.3B in funding over 11 rounds. Their latest funding was raised on Feb 3, 2021 from a Secondary Market round. Unity Technologies recently acquired Peter Jackson’s VFX studio Weta Digital in a bid for the metaverse for $1.6B.

Total employees: 3,379

Metaverse products: 3D development platform

Company’s background: Unity Technologies provides multiplatform tools and services to developers of interactive content. It is the creator of the real-time 3D development platform, giving users powerful and accessible tools to create, operate, and monetize experiences for the real-time world. Unity empowers anyone, regardless of skill level and industry, to create 3D visual content using technology, operate using resources that maximize ease-of-use, and monetize, so that they can find success with their creations. In 2004, David Helgason, Joachim Ante, and Nicholas Francis launched Unity Technologies in San Francisco, California.

- Unreal Engine

Founded: 1991

HQ: Cary, North Carolina (USA)

Amount money raised: TBD (Privately own)

Website: www.unrealengine.com

Investors: TBD

Total employees: 250

Metaverse products: 3D development platform

Company’s background: The Unreal Editor is a fully integrated suite of tools for building every aspect of your project. Advanced features include physically-based rendering, UI, level building, animation, visual effects, physics, networking, and asset management.

C. Metaverse Startups:

In this section we are going to profile select AR glasses vendors, mobile AR companies, NFT vendors, and super maps vendors:

AR/MR glasses startups:

- Magic Leap

Founded: 2010

HQ: Plantation, FL (USA)

Amount money raised: $3.5B

Website: https://www.magicleap.com/

Investors: Magic Leap has raised a total of $3.5B in funding over 11 rounds. Their latest funding was raised on Oct 11, 2021 from a Venture – Series Unknown round. Magic Leap is funded by 28 investors (e.g. NTT DoCoMo, AT&T, Google, Alibaba Group, JP Morgan, Saudi Arabia Public investment fund, etc)

Total employees: 1217

Metaverse products: MR glasses (Magic Leap One, upcoming Magic Leap Two).

Company’s background: Magic Leap is a proprietary wearable technology that enables users to interact with digital devices in a completely visually cinematic way.

Magic Leap is an Augmented Reality US-based startup that is innovating in the AR space to create new hardware and software that will give its users a never-before-seen AR experience and redefine how we access screens and visualize data. The headset combines a user’s inherent visual ability with mobile computing – giving visual output equivalent to real-world experience but powered by mobile tech. Using their Dynamic Digitized Lightfield Signal, they generate images indistinguishable from real objects and place those images seamlessly into the real world.

- nreal

Founded: 2017

HQ: Beijing (China)

Amount money raised: $171M

Website: https://www.nreal.ai/

Investors: Nreal has raised a total of $171M in funding over 6 rounds. Their latest funding was raised on Sep 23, 2021 from a Series C round. YF Capital, GP Capital, Sequoia Capital , are among nreal’s investors.

Total employees: 94

Metaverse products: MR glasses (nreal Light)

Company’s background: Nreal is the developer of ready-to-wear mixed reality glasses. Its flagship product, Nreal light, is the first lightweight and comfortable mixed reality glasses, sporting a vivid display combined with spatial computing algorithms for an immersive experience. The company aims to make mixed reality available and accessible to everyone. They strive to realize the full potential of mixed reality by empowering developers to create applications that can ultimately propel a new era of entertainment, productivity, and more. Nreal was founded in 2017 and is based in Beijing, China.

- Vuzix

Founded: 1997

HQ: Rochester, NY (USA)

Amount money raised: $161M, now publicly traded.

Website: https://www.vuzix.com/

Investors: Vuzix has raised a total of $161.2M in funding over 8 rounds. Their latest funding was raised on Apr 1, 2021 from a Post-IPO Equity round. Intel Capital is the main investor.

Total employees: 109

Metaverse products: AR glasses (M400, M4000, Blades..)

Company’s background: Vuzix is a supplier of video eyewear products in the consumer, commercial and entertainment markets. The company’s products- personal display devices that offer users a portable high quality viewing experience- provide solutions for mobility, wearable displays and virtual and augmented reality. Vuzix holds over 48 patents and patents pending, as well as numerous IP licenses in the video eyewear field. The company has won 13 Consumer Electronics Show Innovations Awards and several wireless technology innovation awards, among others. Founded in 1997, Vuzix is a public company (OTCBB:VUZI.QB), with offices in Rochester, NY, Oxford, UK and Tokyo, Japan.

- Mojo Vision:

Founded: 2015

HQ: San Francisco, CA (USA)

Amount money raised: $159M

Website: https://www.mojo.vision/

Investors: TDK Ventures, KDDI Ventures, NEA, Helios Capital, Dolby Family Ventures, Fusion Fund, etc.

Total employees: 132

Metaverse products: AR contact lenses

Company’s background: Mojo Vision is a developer of augmented reality products and platforms intended to invent the future of computing. The company has developed a smart contact lens with a built-in display that gives timely information without interrupting the focus and delivers immediate, powerful, and relevant information without the intrusions of today’s mobile devices, enabling users to connect with others at a glance, anytime, anywhere handsfree. Mojo Vision was founded in 2015 and headquartered in Saratoga, California.

Mobile AR vendors

- Niantic

Founded: 2010

HQ: San Francisco, CA (USA)

Amount money raised: $770M

Website: https://nianticlabs.com/

Investors: Niantic has raised a total of $770M in funding over 5 rounds. Their latest funding was raised on Nov 22, 2021 from a Series D round. CRV, Coatue, Causeway Media Partners, Samsung Ventures, are among the top investors.

Total employees: 897

Metaverse products: Pokemon Go

Company’s background: Niantic’s mission is to use emerging technology to enrich our experiences as human beings in the physical world. They seek to build products that inspire movement, exploration, and face-to-face social interaction. Originally formed at Google in 2010, they are now an independent company with a strong group of investors including Nintendo, The Pokémon Company, and Alsop Louie Partners. they’re focused on building games that get people outside and exploring by enabling our players to have fun while visiting new places, learning about the world around them, and meeting new friends. We’ve launched Ingress, an immersive real-world mobile game played by millions of people; it’s been downloaded more than 20 million times and is played in over 200 countries and territories worldwide. We’ve also developed Pokémon GO, which has broken records around the world and has been downloaded more than 750 million times in its first year.

NFT vendors

To see the full profiles of the NFT sports vendors (MyLads, Dapper Labs, Sorare, TroposAR, Dachain.io, Open Sea, Nifty’s, etc.) check out our NFT Sports market analysis here.

Recommendations to pro teams and leagues looking to get into the Sports Metaverse market.

- Make NFTs and crypto the backbone of your metaverse’s strategy: This is what Alberto Maiorana, Head of licensing at Sorare, explained during an interview with The Upside: “NFTs and crypto will serve as the backbone for the metaverse. More social platforms will adopt NFTs as they shift to the metaverse, which requires a functioning economy that works across platforms”.

- Focus on openness: This is what Gerbert Vandenberghe, COO and cofounder of Venly.io, explained to us during an interview with The Upside. “The Metaverse will be an open ecosystem where creators can contribute freely and our imagination is the only limit to the endless possibilities. It cannot and will not be owned by one single company. Blockchain and NFTs are the ideal technology to create this open space where people can come together as a member of their communities and contribute to the space. When you start experimenting with the Metaverse, make sure you place your bets on these open technologies as you will have more options towards the future in stead of a vendor lock in”.

- Focus on usability and user experience. Your Metaverse/NFTs should not only be for the crypto natives. The point here is that it is important to offer NFT solutions with a great user experience:

“Vulcan Forged uses Venly’s white labelled wallets, which means that people can sign up to their game with email/password. Then they can start playing the game and collect NFTs. Here the users do not need blockchain knowledge. With the Logan Paul NFT sale, we sold the NFTs through a Shopify store where people could buy them with a credit card. They received a mail in their inbox with a sign up link to Venly to sign up and claim there wallet. By doing so, you can reach a mainstream audience. Just like you don’t need to know TCP/IP to send an email you shouldn’t know anything about blockchain to own an NFT or play a blockchain based game”, said Gerbert Vandenberghe, CEO of Venly, during an interview with The Upside.

- Be informed on the blockchain technology, its pros and cons and the ecosystems of the different blockchains. It is also important for sports organizations to fully understand blockchain technologies as well as its pros and cons. They differ in terms of speed, transaction costs and security. Some have a large engaged community and others fake their traction.

- Use good development partners and development tools. Sports organizations do not need to be a blockchain expert to create Metaverse/NFT applications with the existing tooling. Companies like Venly or Dachain.io provide these tools, which makes it easy to develop user-friendly Metaverse/NFT apps and experiences. Leveraging these tools can save sports organizations a lot of time, effort and money building their Metaverse/NFT apps over time.

- Design your Metaverse/NFTs with marketplaces and wallets in mind. It goes back to offering Metaverse/NFT solutions with the best user experience. In this case, making marketplaces and wallets key components of the Metaverse/NFT buying experience should be top of mind for any teams looking to launch an Metaverse/NFT solution. This is where working with companies like Venly or Dachain.io to offer a white label wallet and market place is critical.

- Respect the NFT standards. There are mainly two standards: ERC-721 and ERC-1155. Respecting these standards will make sports organizations NFTs usable in all wallets and NFT markets.

- Partnerships with other Metaverse/NFT projects can bring extra value to your Metaverse/NFTs. Like with any new markets, join forces with other players in the ecosystem is key. The same applies to the Metaverse/NFT space. Any sports organizations looking to build an Metaverse/NFT solution should try to team up with other Metaverse/NFT companies in order to offer extra value and leverage the expertise, solution and know how of other Metaverse/NFT players.

- Understand that royalties are not automatically enforced by the smart contract.

“The smart contract doesn’t know the price for which an item is traded on a marketplace so it cannot enforce the payment of royalties. It is the different marketplaces that process the royalties. You have to make sure they pay you out your royalties, it is not something that happens automatically after you deployed your contract. There are however standards coming that might make it more transparent, though you will always depend on the marketplaces”, explains Gerbert Vandenberghe, CEO of Venly, during an interview with The Upside. - Leverage Metaverse/NFTs owners’e email addresses for direct marketing purposes: Sports organizations should leverage NFT owners’ email addresses in order to create a new channel for direct marketing purposes and create a direct relationships with the fans.

“If an NFT solution is using a wallet, you can see all blockchain wallets that own an item from Dolce & Gabbana. Therefore, you can target the owners of these wallets by minting an NFT to their wallet, which will show up in their wallet. This can become an interesting marketing channel”, explains Gerbert Vandenberghe, CEO of Venly, during an interview with The Upside.

- Don’t forget legal. It is important for any sports organizations looking to launch an NFT solution to remember that all blockchain based assets are getting regulated. This is not only the case for cryptocurrencies. Therefore it it critical for sports organizations to consult with their legal department or legal experts in order to properly implement their NFT solution.

- Consider the environmental impact of the Metaverse/NFT solution: As we pointed out earlier, creating NFTs, because of the energy used in blockchain verification processes, can have an impact on the environment. This is why it is important to pick NFT solutions or work with NFT vendors (e.g. STARgraph) focusing on mitigating the impact of NFT on the environment.

- Use NFTs as an engagement lever. It is also important for sports organizations to use NFTs as a way to increase fans engagement which will help unlock additional benefits (e.g. drive their top line..) over time.

- Do not base your decision to pick an NFT vendor only based on the NFT vendor’s guaranteed minimums: As a sports organization looking to pick an NFT vendor, picking a vendor primarily based on the guaranteed minimums alone provided by the NFT vendor, is unlikely to be a good strategy for sports organizations. Based on our sources, some NFT vendors are willing to pay sports organizations as much as $500k to secure deals. Instead, sports organizations should pick NFT vendors based on a variety of factors (e.g. environmental impact, business model, customer support..).

- Leverage AR/VR/MR to offer a better workout experience within the Metaverse experience: This is what David Hobbs, Director of Product Management at Mojo Vision, the maker of the world’s first AR contact lenses, explained to The Upside during an interview: “AR/VR/MR creates new possibilities for athletes around improving workouts without breaking focus and flow during drills or exercises. A key driver to create value with the metaverse starts with sports teams providing better data and feedback during training. The current training model emphasizes the feedback loops before a game to prepare and after a game to debrief, but AR offers the unique opportunity during activities to reinforce success in real-time”.

- Focus on providing a Metaverse experience that allows fans to participate directly or indirectly with players and coaches: This is what David Hobbs, Director of Product Management at Mojo Vision, the maker of the world’s first AR contact lenses, explained to The Upside during an interview: “The challenge here is around how to provide that feedback: should athletes receive it directly, or is it best for coaches to provide feedback? As AI improves, this question will become more complicated to answer. Equally important to the player benefits is the ability to engage the fanbase by creating experiences in the metaverse that allow fans to participate directly or indirectly with players and coaches, offer merchandising opportunities and build awareness for new products and experiences on game day”.

- Allocate a good portion of your budget for fans education and communication: Like any new technologies it is sometimes difficult for sports organizations to fully understand new technologies. In this particular case, sports organizations should allocate a good portion of their Metaverse/NFT budget to educate their fans on how to properly use Metaverse/NFTs. This could be done via a variety of ways such as webinars, white papers, educational videos, etc. The education part is critical here. It will help sports organizations successfully launch their Metaverse/NFT solutions.

Bottom line: There is currently a lot of “hype” in the Metaverse Sport. In our view, it is critical that sports teams do their due diligence on those metaverse startups. Like any new emerging markets, there are some really solid Metaverse companies out there but there are also some Metaverse vendors without solid business models or no business models at all. The vast majority of the sports teams we talked to want to work with Metaverse vendors that have a solid business model in order for them to get the best ROI. When it comes to choosing their Metaverse sports vendors, sports organizations need to focus on building a full Metaverse solution (wallet, market place..) with a seamless user experience, and with super maps, AI and AR/VR/MR components as part of the Metaverse experience. They also need to focus on educating fans about Metaverse and NFTs to guarantee success and mass adoption. Only time will tell what will be the “killer” Metaverse use case, but one thing is clear: This is an exciting time we are living in. Ultimately, like with the NFT space, we also expect to see M&As activities in the Metaverse space accelerate in 2021 and beyond.

Leave A Comment

You must be logged in to post a comment.