Two years ago there was a lot of excitement about the eSports market with many pro teams (e.g. soccer clubs, basketball teams, etc..) launching their esports teams. So what is the state of the esports market today? Are pro teams still focused on the world of esports? This is what we plan to discuss in this analysis. But before we do that, let’s talk about the current trends, the market size, the ecosystem. As we noted in a previous analysis, the numbers are staggering:

In terms of install base, according to Statista, the eSports market is expected to reach 454M users globally this year and grow to 644M users globally by the end of 2022.

There will be 29.6 million monthly esports viewers in the US at the end of 2022, up 11.5% from 2021, according to Insider Intelligence estimates.

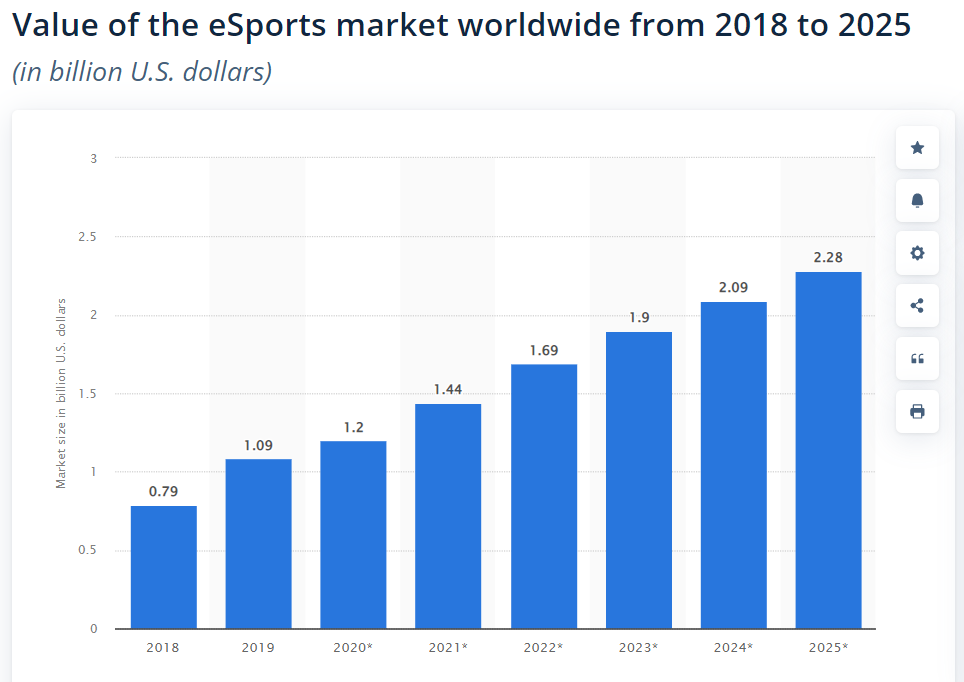

In terms of revenue opportunity, according to Statista, the global eSports market is expected to reach the $1.69B market this year and grow to $2.28B by 2025.

Source: Statista, 2022

Esports’ largest tournaments are nearly as large as traditional sporting events.

The League of Legends Championship, a major eSports event, sold out the 15,000-seat Los Angeles’ Staples Center in an hour in 2016, then sold out the 40,000-seat World Cup Stadium in Seoul while drawing an online audience of 27M.

The Intel Extreme Masters tournament, held in Katowice, Poland, drew 173,000 fans to the stadium over two weekends.

Other popular global esports venues include London’s Wembley Arena (12,500 fans) and Seattle’s KeyArena (10,000 fans).

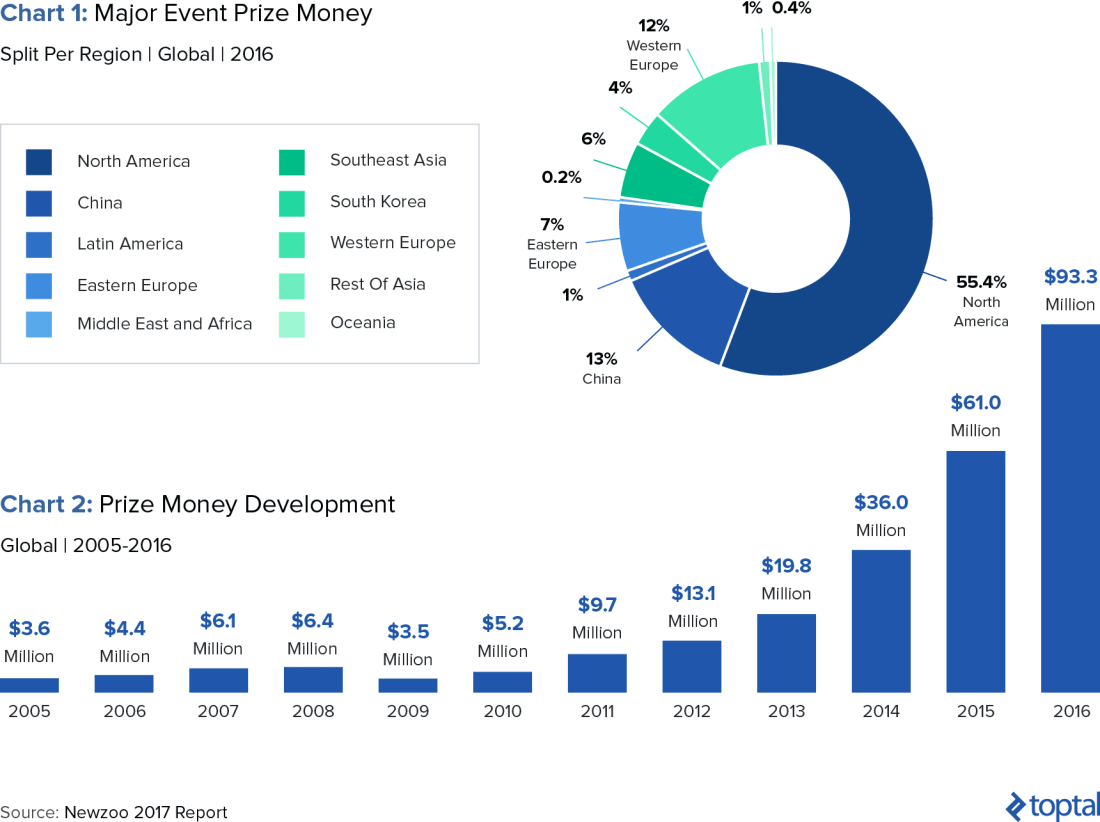

Total prize money in 2016 for the largest tournaments reached $93.3M, up from $61.0M in 2015 and up from from $5.2M in 2010.

Over the past few years, many leagues (NBA, MLS, NFL) and professional soccer clubs in Europe (PSG, FC Schalke 04..), North America (Sixers/NBA, Warriors/NBA..), and South America have signed professional eSports gamers as they are trying to take advantage of this fast-growing market, attract a new audience and sponsors, and drive additional revenues. Celebrities like Shaq, Steph Curry, Robert Kraft, Ashton Kutcher, Jerry Jones, just to name a few, are all investing into eSports.

The number of investments in esports doubled in 2018, going from 34 in 2017 to 68 in 2018, per Deloitte. That’s reflected in the total dollars invested, too: Investments are up to $4.5 billion in 2018 from just $490 million the year before, a staggering YoY growth rate of 837%, per Deloitte. These investments are distributed to players across the ecosystem—from esports organizations, to tournament operators, to digital broadcasters—allowing it to function and grow.

Now if we look at the financials of esports teams, as shown in the table below, many esports teams are not profitable today. For example Faze Clan had $36.9M in revenue losses in 2021 while EnthusiastGaming had $41.6M in revenue loss.

As of 2020, the top five most valuable esports teams according to Forbes are:

TSM

Estimated Revenue: $45 million

Revenue from Esports: 50%

Owner: Andy Dinh

Cloud9

Estimated Revenue: $30

Revenue from Esports: 70%

Owners: Jack and Paullie Etienne

Team Liquid

Estimated Revenue: $28 million

Revenue from Esports: 89%

Owners: aXiomatic Gaming, Victor Goossens, Steve Arhancet

FaZe Clan

Estimated Revenue: $40 million

Revenue from Esports: 20%

Owners: Lee Trink, Richard Bengston (FaZe Banks), Thomas Oliveira (FaZe Temperrr), Yousef Abdelfattah (FaZe Apex), Nordan Shat (FaZe Rain)

100 Thieves

Estimated Revenue: $16 million

Revenue from Esports: 35%

Owners: Matthew Haag, Drake, Scooter Braun, Dan Gilbert

But here are the questions: Are most pro teams and leagues getting a solid ROI and fully monetizing eSports? Who is actually making money?

Some argue that the eSports market has not met expectations yet, that most pro teams and leagues are still trying to figure out how to get a solid ROI from eSports and fully monetize this discipline. As a result of that, some pro soccer teams have already pulled the plug and shut town their eSports teams:

This is the case of Russian soccer club FC Anzhi Makhachkala which shut down its eSports division just four months after launching its new eSports franchise.

Some experts like Cecilia D’Anastasio of Kotaku who spoke with seventeen different esports experts also expressed potential concern over the true health of the eSports industry. Those experts argue that in the world of eSports, there are no standard viewership measurements, some potentially inflated view counts, among key issues.

- Issue #1: There is no standard viewership measurements: Unlike most traditional sports leagues, viewership numbers are reported either by the game publishers, the esports teams, or the streaming platform. But they are trying to fix this with Riot games saying they are “actively working with a number of entities in the esports and measurement industries to establish standardized data and measurement systems.” Average Minute Audience is also the new figure that publishers like Riot and Blizzard are reporting.

- Issue #2: The view counts might be inflated..and revenue estimates as well: One of the areas the industry is battling is how to decern junk views vs. real views. According to a former Twitch employee, junk viewers are defined as “someone who’s logged in but not engaged with the content,” and are a view that “only exists to increase a metric for somebody in sales or business development.” According to the report, boosting viewership numbers with junk views is a common practice. The eSports revenue estimates might be inflated too. But some argue that it is difficult to trust much public data on the esports industry, and some experts have even issues with NewZoo’s numbers, with some saying that NewZoo’s calculations are too opaque to be reliable.

- Issue #3: The negative impact of influencers: With more fans wanting to follow streamers like Ninja and not whole teams, some believe that influencers are “short-circuiting” the industry. Because influencers are making so much money, they are driving up the salaries of players on teams, leaving the teams with salaries that are “at completely unsustainable levels.”

So is the world of eSports going through a bubble that is about to burst?

“It doesn’t make sense to put that much money into an industry that’s not making that much. The sooner we recognize that we’re fooling a bunch of non-endemic people, the better off we’ll be long-term. We’ll be able to fix this bubble before it pops.” – Frank Fields, Esports and Sponsorship Manager for Corsair

The point of this eSports analysis is not to be negative about the eSports industry but to try to discuss the state of the eSports industry and discuss the hype Vs the Reality of the industry. Now some may strongly disagree with the points raised above. This is just a point of view.

Now let’s talk about the mechanics of the eSports industry. But before we get into the best practices on how to successfully enter the world of eSports as a team or league, let’s talk about the monetizing strategies and the key players of the eSports ecosystem.

So how do the key players in the eSports space make money?

There are various ways to make money in the eSports space. Those include advertising, sponsorship, merchandising, ticket sales, concessions at events, media rights, streaming videos, and prize money.

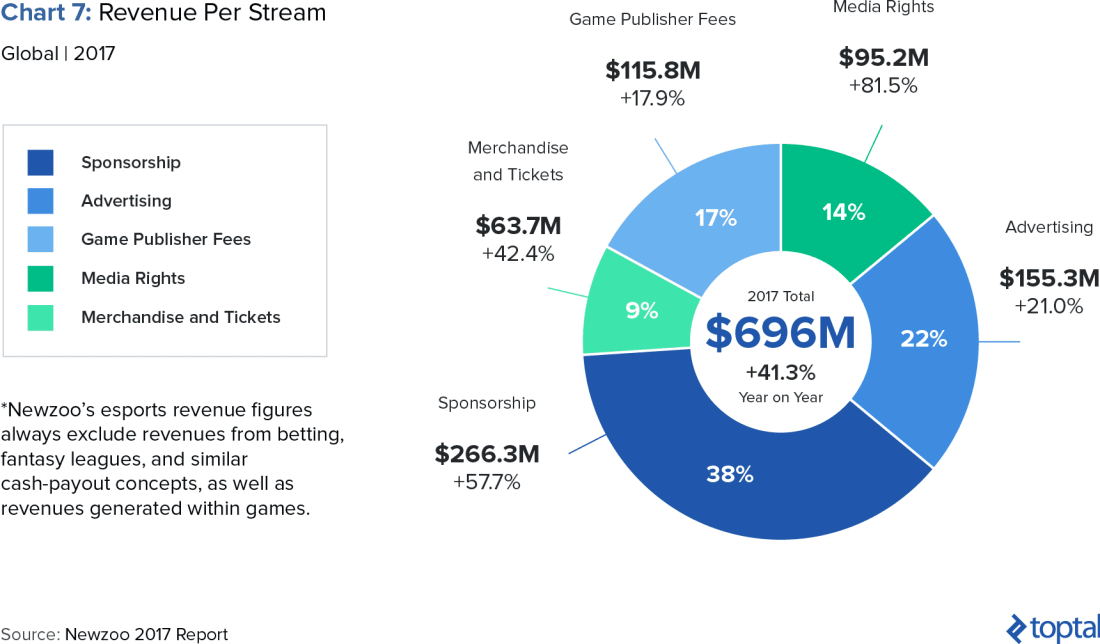

Let’s take the eSports revenue breakdown from 2017:

(1) Advertising: It is typically the revenue generated from the ads targeting esports viewers, including ads (Intel, Samsung, Coca-Cola, RedBull, etc.) shown during livestreams on online platforms, on VOD content of esports matches, or on esports TV. Generating 22% ($155M) of the eSports industry, advertising is the second largest source of revenue right now. It is expected to grow to $224M by 2020.

(2) Sponsorship: Sponsorship is the #1 source of revenue for the eSports industry, capturing 38% ($266M) of eSports total revenues. It is expected to reach $655M by 2020.

(3) Game publisher fees: Game publisher fees currently capture 17% ($115.8M) of total eSports revenues. This segment is expected to experience slow growth in the coming years though.

(4) Merchandise and ticket revenue: It is typically money generated from the sale of merchandise and live tournaments.

(5) Media rights: Media rights revenue can be defined as the revenue paid to industry stakeholders to secure the rights to show esports content on a channel. This includes payments from online streaming platforms to organizers for broadcasting their content. This also includes foreign broadcasters securing rights to show content in their country and paying for copyright to show video content or photos of esports competitions. Media rights currently capture 14% ($95M) of eSports total revenue, and are expected to grow to $340M by 2020.

So what the key players involved in the eSports market?

Let’s start by defining the key eSports segments:

(1) Teams: Pro eSports gamers are typically part of eSports teams. Those teams specialize and compete in specific games like the League of Legends, Dota, or Counter-Strike. Some of the most well known eSports teams include Evil Geniuses, Fnatic, and Optic Gaming.

(2) Organizations: Typically the best eSports teams are recruited to be part of top eSports organizations that specialize in specific video games but operate under the same name such as Cloud9, NRG, TSM, Optic Gaming, or Fnatic. The way to think about it is like in the NCAA where colleges have various sports teams (basketball, soccer, football..) under the same organization.

(3) Leagues: Esports teams, representing the organization (Cloud9, NRG, Fnatic..) they are a part of, compete in their video game’s respective league where there are regular seasons, playoffs, and world championships. League tournaments are run by companies such as Major League Gaming (MLG) or the Electronic Sports League (ESL). The most well known eSports leagues in North America include the League of Legends Championships Series, or the Pro League for CS:GO (organized by ESL), or the Call of Duty World League (organized by MLG).

(4) Publishers: Each eSports game is the intellectual property of the game creator, which are commonly called “publishers.” The most well known publishers are Riot Games, Valve, Activision, among others. Those publishers have rights around where the game is played, who can host video game tournaments, and more.

Some experts like Michael DE WIT, General Manager at DM-Esports, LLC (owner of the Paris Eternal – Paris franchise of the Overwatch League) believe that publishers must be more flexible and listen to investors/eSports organizations. “In the medium / long term, the esports will have to open dialogues with the publishers. The inherent specificity of this industry gives the publisher full powers through his intellectual property. If we want the economy of esports to develop serenely, then publishers must be flexible and attentive to investors / actors. The big unknown will remain the opportunity or not to create counter-powers against publishers”.

(5) Tools/platforms and marketplaces: There are a myriad of eSports tools, platforms and marketplaces. Those include: (a) Livestreaming platforms: Those platforms include streaming services, game highlights, and esports analytics. Twitch and YouTube are among the most popular platforms. Twitch reached 5B total hours streamed in 2016. (b) Aspiring pro eSports gamer and fan resources: It usually includes everything from news sources, industry statistics tracking, coaching, and skill improvement tools. (c) Professional gaming – platforms and infrastructure: It usually includes tournament platforms (e.g., Battlefy) and communication tools (e.g., Discord). (d) Betting and item marketplaces: It typically includes esports gambling, fantasy, and item marketplaces for in-game customization.

So at what stage currently is the eSports industry? Some experts believe that the industry is still in full building mode.

“As the esports transforms itself from being a niche phenomenon to a phenomenon of society, its biggest challenge remains its structure. Whether in France or in the rest of the world, the industry is still in full building mode – its legislation but also its business and valuation remain to be defined and clearly identified. I think that the esport benefits enormously from the current “start-up” of the current generation, and that’s a good thing. But if the esports wants to continue, we must move away from that and create a solid ecosystem at all levels”, believes Michael DE WIT, General Manager at DM-Esports, LLC (owner of the Paris Eternal – Paris franchise of the Overwatch League)

Mr DE WIT also believes that the eSports industry can be divided into 3 various types of groups depending on their respective strategies.

“In this construction phase, there is a wide range of strategies adopted by the major players in the esports industry. As for the clubs / teams, I think we can divide them into three categories: the “trendy” esports with small short-term investments (eg team present on games such as Apex Legends, Fortnite) , esports category with large long-term investments (eg Overwatch League, League of Legend) and an intermediate category where we continue to apply the codes that gave birth to the world of esports (e.g. Dota 2, Counter- Strike)”, says Michael DE WIT, General Manager at DM-Esports, LLC (owner of the Paris Eternal – Paris franchise of the Overwatch League)

So what should a team or league do to successfully enter the eSports space and get a solid ROI?

(1) Do your homework about the esports space to make sure you understand the esports space and can bring value to it:

“First, do your homework, understand all the small subtleties and big details of this competitive space. Learn before you act. See where your organization would bring value either from a competitive or from a business standpoint. As more and more player from the “traditional” economy are pouring into Esport there is still space to fill for traditional sports and media but make no mistake, ESport has its own ecosystem working very well, its own media, its own governing bodies and so on. It’s not like they need you, that’s the first thing that needs to be understood”, said Sebastien Audoux the head of Digital Sports Content at Canal +, during an interview with The Upside.

(2) Be humble and study the game of esports in order to avoid huge mistakes and losses:

“Be humble and don’t see Esport as just sports with a keybord and a mouse, it’s a very specific competitive landscape with its own codes, values and trends. I would suggest spending hours listening to exec from esport teams, shoutcasters, fans etc. before making any move. Rushing in that area could mean huge mistakes and losses”, said Sebastien Audoux the head of Digital Sports Content at Canal +, during an interview with The Upside.

(3) Find the right partners or esports partner to drive your esports strategy:

“Find the right external partner or the right esports expert to help you drive your esports strategy and business. You need someone who has experience working for an esports team and understand the ecosystem, how it works, and won’t be lost working for a club”, said Xavier Oswald, Managing Director-Business and Strategy, Karmine Corp, a leading French esports team, during an interview with The Upside.

(4) Understand which esports market (Asian, Brazilian..) you want to focus on:

“If a club wants to focus on the Asian esports market, it won’t be the same esports video game required when targeting the Brazilian or North American esports markets. These are not the same games that esports gamers will play on. You need to focus on the esports games that are mostly used when targeting a specific geographical esports market”, said Xavier Oswald, Managing Director-Business and Strategy, Karmine Corp, a leading French esports team, during an interview with The Upside.

(5) Clearly define your goals when entering the esports space:

“If a professional club just wants to enter esports to do a PR campaign there is not really a point there, but if the professional club really wants to develop a global esports strategy with a bridge between its sports (soccer, basketball) and esports gaming they really need to think it through, said Xavier Oswald, Managing Director-Business and Strategy, Karmine Corp, a leading French esports team, during an interview with The Upside.

“Esports is the competitive aspect of gaming, so if a professional club wants to do some gaming, it is not esports. For example if you take the analogy in basketball between the LA Lakers and the Harlem Globe Trotters, the LA Lakers are here to win the NBA championship while the Harlem Globe Trotters are here to entertain, which brings the questions to the clubs: “Do they want to launch an entertainment/gaming division with Twitch with influencers and some content creators or do they really want to position themselves as a professional esports team with gaming competitions? These are 2 distinct strategies”, explained Xavier Oswald, Managing Director-Business and Strategy, Karmine Corp, a leading French esports team, during an interview with The Upside.

(6) Go meet the esports gaming editors and the key players in the esports ecosytem:

“It is also key to go meet the esports gaming editors and key players in the esports system when entering the esports market. That way a club will be able to learn and fully understand what works and does not work in esports, explained Xavier Oswald, Managing Director-Business and Strategy, Karmine Corp, a leading French esports team, during an interview with The Upside.

(7) Focus on developing your esports community:

“Often times professional clubs (soccer, basketball) do not focus their efforts on creating and developing their own esports community, which is a big mistake because this is a key success factor when entering the esports space”, said Xavier Oswald, Managing Director-Business and Strategy, Karmine Corp, a leading French esports team, during an interview with The Upside.

(8) Focus on long term gain Vs short term gain: Some argue that many pro teams and sports organizations are trying to get quick wins and are not focusing on eSports for the long run. Instead what sports teams, who want to be successful in sports, should do is to roll up their sleeves, and have a long term vision and commitment towards eSports. Like they say “No pain no gain”.

“There’s never any quick wins in this business, and there’s an awful lot of blood, sweat, and tears that need to go into it. And I think everyone who is successful in this industry has had those times where they’ve had to really roll up their sleeves, and we’re no different”, said Ben Payne, the former eSports director at McLaren (F1), during an interview with The Upside.

(9) Do not stretch yourself too thin too quickly:

“I think that you do see people stretched too thin too quickly, which leads to what you’re describing (Some teams exiting eSports)”, said Ben Payne, the former eSports director at McLaren (F1), during an interview with The Upside.

(10) Do not try to replicate the same experience of your sports for eSports but respect the specificity of eSports. Listen to the eSports community and your staff in order to offer the best eSports experience:

“It is about listening to the community and it’s the fans, it’s your broadcast, it’s listening to your players. Oftentimes, the changes we’re making from week to week, they might come from our staff just in the studio sitting with players and talking to them and finding out what they think we should be doing differently”, said Brendan Donohue, Managing Director of the NBA 2K League, during an interview with The Upside.

(11) Combine the best of traditional sports with the best of eSports:

“Generally speaking, traditional sports are really good at the business. Whether that’s putting on a production or it’s creating great partnership or marketing the product. That’s really in their wheelhouse. (..) We initially took the approach of, how can we take the best of Esports and the best of traditional sports? That has been our mindset all along. There are a lot of amazing things that I think traditional sports brings to Esports. If you followed our League, you’ll know we have a very, you might call it a traditional draft that the players love and their families love and it creates that moment. The perfect moment we had this year was Chiquita being drafted and that moment when the audience erupted”, said Brendan Donohue, Managing Director of the NBA 2K League, during an interview with The Upside.

(12) Run your eSports team like any other businesses with its own P&L, KPIs and financial goals:

“I think what you need to do is you need to build yourself a way of operating on a budget that is feasible for that 12-month period (..) We are all held accountable to the money we bring into the business and spend on behalf of the business”, said Ben Payne, the former eSports director at McLaren (F1), during an interview with The Upside.

(13) Be transparent with your partners and internal stakeholders:

“The recipe for success is to be transparent with your partners and your internal stakeholders as earlier and as regularly as you can be, and as honest with yourself as you can be”, said Ben Payne, the former eSports director at McLaren (F1), during an interview with The Upside.

So ultimately has there been a lot of professional clubs (soccer, basketball..) that successfully entered the esports space? As of today the answer is: Very few clubs successfully entered the esports space.

“There has not been a lot of professional clubs that successfully entered the esports space. For example PSG is one of the few clubs that successfully entered the esports space through a strategy based on licensing. PSG essentially licensed and teamed up with local esports clubs (PSG LGD for the Dota, PSG Talon on League of Legends). Shalke 04 and Barcelona FC are two other clubs that entered the space successfully. In the US Dallas Cowboys owner Jerry Jones and investor John Goff invested into Complexity Gaming an esports team”, concluded Xavier Oswald, Managing Director-Business and Strategy, Karmine Corp, during an interview with The Upside.

Bottom line: There is no question that the interest among professional clubs towards esports is not as strong as two years ago, but there are a few clubs who successfully entered the esports space. Whether or not the numbers associated with eSports are inflated is debatable. But there is no question that there is still good interest towards eSports from sports leagues and teams, who want to attract a new audience, new sponsors and potentially drive their top line. To successfully enter eSports, pro teams and leagues need to truly operate their eSports division as a business led by executives that used to work in the esports space. They also need to have a long term vision, and be transparent with their partners and stakeholders. They should also listen to the eSports community in order to offer the best eSports experience. These are some of the keys to success to successfully monetize the eSports opportunity.

Leave A Comment

You must be logged in to post a comment.