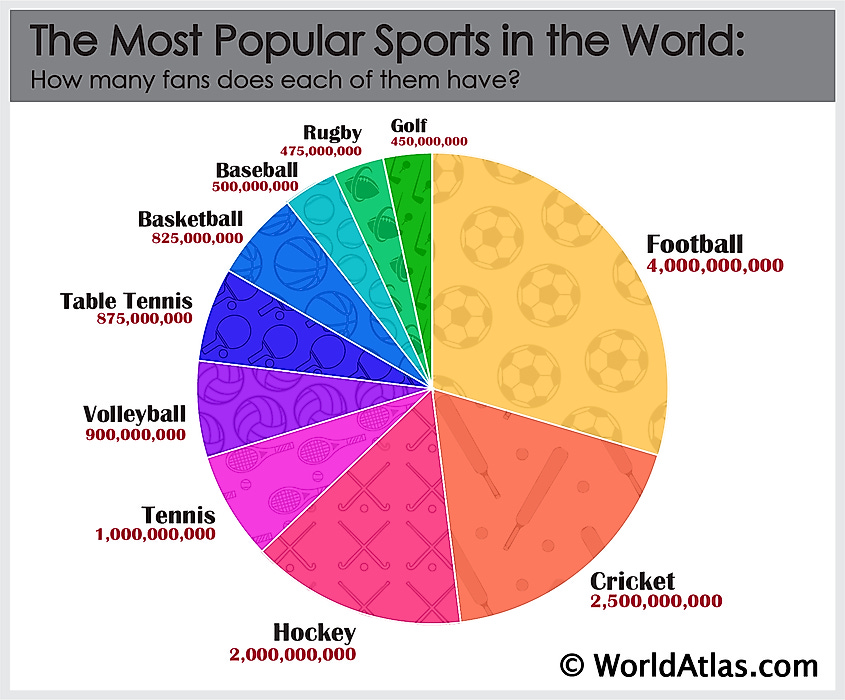

Soccer is by far the most popular sports in the world with 4B soccer fans globally, according to Worldatlas.

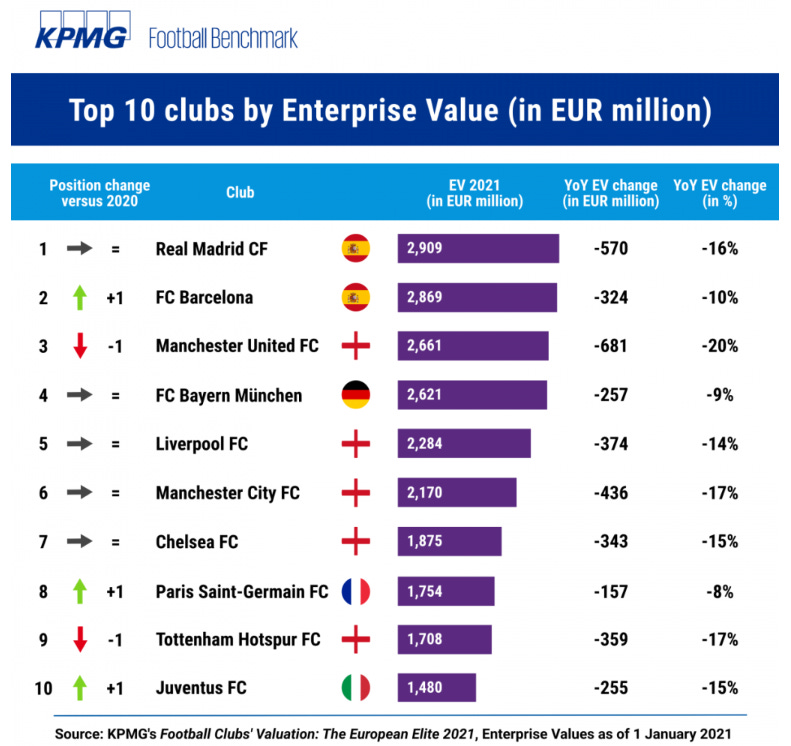

The Top 10 Football Clubs by Market Value

Real Madrid have retained their position as the most valuable European football club for the 3rd consecutive year, with an Enterprise Value of €2,909 million, ahead of Barcelona and Manchester United, according to KPMG’s report “Football Clubs’ Valuation: The European Elite”.

For the first time, Barcelona have jumped to the 2nd position with an EV of €2,869 million, while Manchester United take the last step of the podium with an EV of €2,661 million, a 20% decrease compared to 2020.

While all three clubs on the podium increased their EV last year (Los Blancos by 8%, the Blaugrana by 19% and the Red Devils by 4%), this time they suffered an EV decline of 16%, 10% and 20%, respectively. The same three clubs have also dropped below the EUR 3 billion threshold, which they surpassed last year.

In the top 10, PSG moved up to the 8th position, overtaking Tottenham, while Juventus returned to the top 10, replacing Arsenal, who have lost six positions since the first, 2016 edition of our ranking.

Atalanta, Olympique Marseille and Fenerbahçe are new joiners in this year’s report, while West Ham, Athletic Bilbao and Beşiktaş have dropped out.

Aggregate value has decreased by €6.1 billion

The impacts of the COVID-19 pandemic have been clearly reflected by the financial performance indicators of Europe’s most prominent football clubs.

After years of constant growth, the aggregate EV of the 32 top clubs has decreased by €6.1 billion (-15%) year on year, down to €33.6 billion, a value slighty higher than 2018 level.

Broadcasting and matchday income were impacted to the greatest extent by the pandemic, whereas commercial revenues slightly increased, mainly thanks to agreements signed before the start of the health crisis.

The impact of the pandemic is apparent in clubs’ profitability as well: only seven of the top 32 clubs reported a net profit, while there were 20 profitable clubs in this elite a year before.

More Money in the Game

That being said, Football clubs have witnessed more money being thrown into the game, partly because of the licensing and streaming deals behind the curtain. Big entities have entered the space like Amazon, Disney through ESPN, and DAZN, which has been regarded as the Netflix of sport.

From an audience standpoint, business interest in the sport is justified. In the last World Cup final, 517 million tuned in, compared to 160 million for the Super Bowl during the same year.

Soccer Tech Ecosystem: Key Categories and Vendors

Now let’s move on to the soccer tech ecosystem. The key tech sub-segments are as follow:

(1) ? Wearables: This segment typically includes wearables from various shapes and forms such as smart patches, smartwatches, fitness bands, smart t-shirts, smart shorts, smart shoes/insoles embedded with sensors capable of measuring athletes’ biometric data (HR, HRV, workload, fatigue, breathing, height, hydration, and more). Key players include companies like Hexoskin (smart clothing), Polar (HR/GPS/smart clothing), Sensoria (smart clothing/footwear), Strive (EMG sensors), Myontec (EMG sensors), Neurocess (EMG sensors), Vert, IOFIT (smart footwear), Adidas, Samsung, Apple, Sony, Fitbit, Plantiga (Smart insoles), Garmin, LG, Kenzen (Armband), Bisu, Huawei, Motorola, Gatorade/Epicore (smart patch), Flowbio (smart patch), iRythm (smart patch), BioBeat (smart patch/watch), Masimo (smart patch), Nix Biosensors (smart patch), Vital Connect (smart patch), among others.

(2) ⌚️Communication Tools: These are typically communications platforms (registration, messaging, scheduling), used by soccer coaches, teams, tournament organizers, parents to better run events, matches, communicate with each other, and exchange information. The types of info exchanged can be players’ performance data, through apps equipped with notification types features. Ker players in the space include companies like Teamsnap, Teamworks, Band, Blue Star, Soccer pulse, and Peak performance network.

(3) ?? Athlete Management Tools: These are typically player assessment & performance tools used by coaches in training and live games. Some of these tools track and analyze statistical (video analysis, distance ran..) and performance data (GPS, workload, HR, Motion, hydration, fatigue..) via the use of wearables and GPS trackers (Catapult, Stats Sports, Polar, Mclloyd, etc..) Key players in the space include AMS (Athlete Management Systems) companies like Sportgo, Apollo, Kitman labs, Kinduct, Fusion Sport, CoachMePlus, Rock Daisy, Edge10, Soccer System Pro, Benchmark54, MyCoach, SAP, Train My Athlete, Iterpro, ProSoccerData, Athlyts, Soccer Bi3, Monilabb, TopSportsLab, SoccerLab, or Mobii. You can check out our full analysis on the AMS space here. Another vendor in this category includes Orreco which uses blood analysis to help reduce the risk of injuries and measuring players internal load.

(4) AI based solution vendors: This typically includes companies that build AI based platforms with advanced algorithms. Companies like Zone 7 (AI based solution) fall into this category. Some of those AI software can be quite sophisticated. For example, Zone 7 software understands the baseline of each player, can predict specific types of injuries (knee, etc..) with 75% accuracy and can provide recommendations for each player (e.g. do not exceed more than 20 miles per hour in next drill, or run 3 km max ..).

(5) ? Coach Management Tools – The Coaching Manual, Backyard Coach, Coachbase, HomeCourt, Hivelearning. Typically these tools provide resource built for soccer coaches who want to improve their understanding of coaching, find real practical sessions which they can use and accelerate the development of their players by creating a learning environment.

(6) Thermography solution vendors: This typically includes companies that built Thermography solutions (advanced camera + software). Companies like ThermoHuman fall into this category. Companies like ThermoHuman, which is based on the analysis of temperature, have built metrics mainly based on asymmetries and help teams reduce muscle injuries and quantify internal load. Another key vendor in this category is OmniAthlete.

(7) Biomechanics (Motion tracking..): Typically those include companies that offer 3D motion tracking technology and products that can be used for health & sports performance purposes to help teams assess risk of injuries. Xsens, OptiTrack, NDI, Motion Analysis, Vicon, Qualisys, just to name a few.

(8) Sports VR: This category includes 4 types of VR experiences: (a) Live VR broadcasting, which can be described as an experience enabling fans to watch live basketball games in a “virtual” environment. Key players include companies like C360, VANTRIX, and Intel which provide the VR cameras and broadcasting platform. (b) Social VR, which can be described as a VR experience where fans can virtually watch live or recorded basketball games with others & with stats and from multiple angles in VR. Companies like LiveLike VR or Virtually live, are the way there. (c) VR documentary & e-commerce: This VR experience enables fans to watch behind-the-scene documentaries in VR and even buy associated content (jersey and hats) while consuming VR content. Leading players here are companies like The Dream VR, or Laduma VR. (d) VR training: These are virtual training systems used by players to virtual train, watch virtual plays, learn about new skills, and prepare themselves against other teams, or stay mentally fit during injuries. Key players include companies like STRIVR Labs and WIN Reality.

(9) Augmented video vendors: ShotTracker, SMT, Champion Data, Sportlogiq, and Second Spectrum, who are creating AR overlays on mobile, AR glasses, and live TV.

(10) ? Pure AR /Mixed Reality (MR) glasses and app vendors: This category includes the AR/MR glasses vendors like Magic Leap, Samsung, Microsoft, Meta, Huawei, Innovega, Mojo Vision, and Google, who build the smart glasses that create a handsfree experience and display AR as an overlay. This category also includes companies who build AR experiences like ShotTracker.

(11) ? eSports: This includes eSports soccer teams associated with leading soccer teams (PSG, Schalke 04, F.C. Copenhagen, etc.). The eSports gamers typically typically compete in eSports competitions. If you want to learn more, we covered the eSports market here.

(12) ?Voice assistants and chatbots: This category includes chatbots enabling fans to get score updates, order associated content, watch video highlights, play games and more. Besides large tech companies like Google, Samsung, Alibaba, Facebook, Microsoft, and Nuance, that have built chatbot solutions, other leading chatbots startups include companies like Satisfi Labs, ReplyBuy, and Inference.

(13) NFT Sports vendors: From NFT creators to NFT marketplaces (Crypto.com, DaChain, Binance, FTX, Autograph, Open Sea, Reality Gaming Group, STARgraph, or Venly). You can check our full analysis here.

(14) Metaverse Sports vendors: From Metaverse Discovery tools…to Metaverse creators tools (Nike, adidas, Fortnite, Meta, Minecraft, Activision, Ubisoft, Twitch, Dream VR, Niantic, Tencent, Playstation, Nintendo, Valve, 2K, just to name a few). You can check our full analysis here.

(15) ?Neuroscience & biofeedback: These are technologies that enable the visualization of brain wave activities as well as the measurement of data such as ECG. It can be typically worn on the head and can also be used to measure biofeedback to help athletes relax and be in the zone when they need to perform during sports events. Key players are Muse, Mendi, or NeuroSky, among others. And companies like Halo also built a neuroscience based device enabling athletes to increase neuroplasticity. Lastly companies like REBALANCE Impulse developed a solution for players that combines neurotechnology, with apply neurosciences, color and sound therapy to create an effective stress-reducing experience.

(16) ?Sleep monitoring: These are usually smart devices (e.g. mask, headband, watch..) capable of monitoring the athletes’ sleep and even making them fall sleep. For example Sana built a smart sleeping mask that uses pulses of lights and sounds and can make athletes sleep in 15 minutes. Other companies focusing on this area include companies like Fullpower Technologies, Remedee Labs (wristband that releases brain endorphins), Fatigue Science (watch), Dreem (headband), Philips, Whoop (Watch), to name a few.

(17) Sports DNA genomic: These are usually DNA testing products that are used by soccer teams to test everything from players’ metabolism to caffeine tolerance. It is also a way to provide custom nutrition plans to soccer players. Leading vendors in this space include companies like DNAFit, Nutrigenomix, and Orig3N.

So what are the future trends and which emerging technologies should we expect to see in the world of soccer in the coming years?

Current and Future Tech trends affecting the world of Soccer:

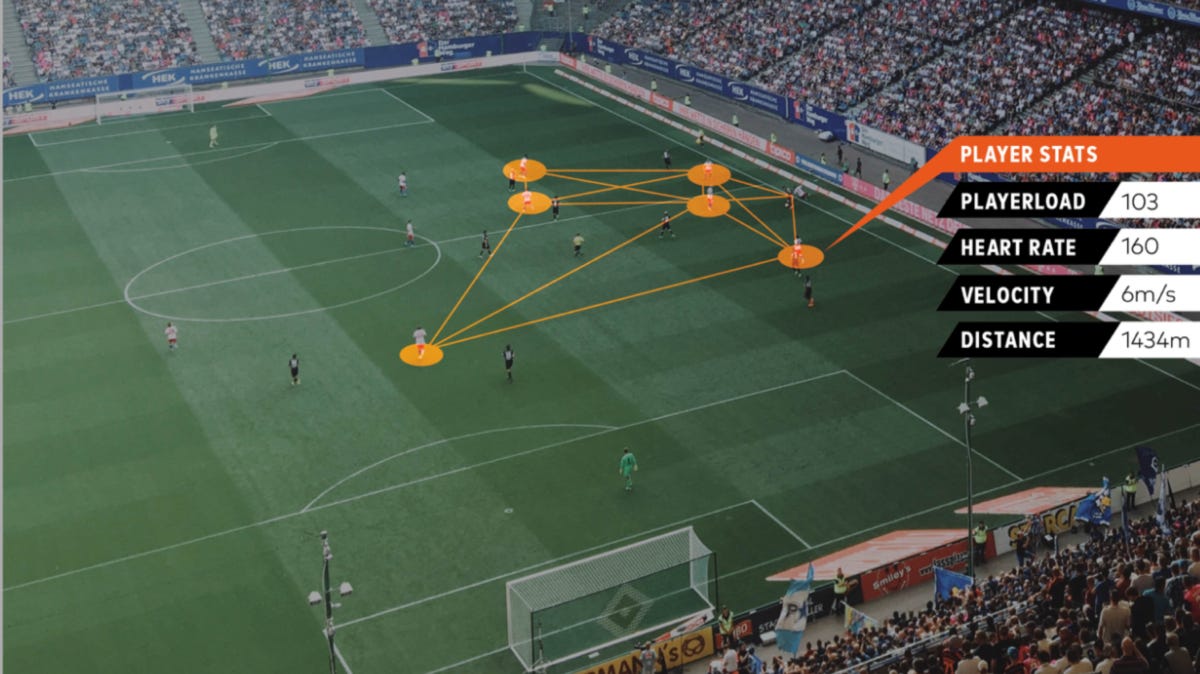

1.From TV 2.0 to TV 3.0 with soccer players’ statistical and biometric data as AR overlay on live TV:

Nowadays, the soccer viewing experience on live TV is already augmented with live statistical and biometric data (e.g. HR, load, velocity, distance ran..) of soccer players.

Key players in this area include companies like Catapult, Mclloyd, WIMU, ShotTracker, Second Spectrum, Zebra, just to name a few.

For example, Catapult, which acquired sports video company XOS Digital, currently offers a solution called Vision is the first product born from that merger with XOS Digital. Basically Vision syncs wearable tracking data with video, giving analysts and coaches another key input when reviewing game play. If a midfielder was out of position in a formation, the wearable might indicate either a poor decision or a physical inability to get to the intended spot. The Vision platform adds features to the player data such as the ability to draw on the video, automated tagging, and sharing.

Catapult Sports’ vision

In the future, with the emergence of new advanced wearables, we believe that broadcasters, teams and leagues, will share new types of biometric data such as fatigue level, hydration level, stress level, or human power. This will help enhance the soccer fans experience on live TV.

2.In stadium MR/AR apps showing live biometric data of soccer players are under way:

Based on our conversation with pro teams, soccer leagues, tech companies, we believe that in the next 24 months we will see the emergence of AR or mixed reality (MR) apps from Microsoft Hololens and Magic Leap that will use ShotTracker playbook in order to allow fans to wear a pair of smart glasses at a stadium and look at a player on the soccer field and see their statistical and biometric data just by looking at them at a live sports event.

Many soccer fans believe that Kylian Mbappe is one of the fastest players in the world. Now with this type of AR/MR app a PSG fan could attend a live PSG game and point at Kylian Mbappe and get Mbappe’s live statistical/biometric data that way. We believe that this would help make the live soccer experience even more entertaining for fans. It could also potentially help bring more fans to soccer stadiums.

You can see below the ShotTracker AR app which enable fans to point to a player on the field and see live statistical data as an AR overlay. You can watch the video of this AR app here.

As we noted earlier, we also think that live betting will become a key part of the augmented video experience. The idea here again is to allow fans to watch augmented video replays and bet on the next play, and compete with their friends in real-time during live games. Ultimately this will enhance the fans experience, increase fans engagement, drive ticket sales, and teams’ top line.

3. eCommerce to help fully monetize VR fans experiences:

We believe that e-commerce will become a core piece of those types of VR soccer fans experiences (Live VR, social VR, social VR documentaries). As we noted before, The Dream VR is the perfect examples of this. They built a patented unique VR e-commerce experience which enables their customers (Real Madrid and F1) to sell their associated items (Jerseys, tickets..) throughout the VR experience and on top of the VR subscription that their VR users already have to pay. The Dream VR is able to do this as they have a unique global partnership with Fanatics. That way the Dream VR is able to sell those associated items from pro teams and leagues throughout their VR experience. By partnering with companies like The Dream VR, the teams and leagues will be able to better monetize the VR fans experience, and drive their top line.

Picture: The Dream VR’s e-commerce experience with Real Madrid

4. Growing number of teams, players and athletes set to launch their own Metaverse/NFT platforms:

Just like in the VR space, we expect to see major athletes to launch their own NFT/Metaverse channels in 2022. The idea there is for them to have special NFT drops (video clips, special collections, VIP passes..) on their channels (Instagram, Tiktok..FB, Twitter, Snap) and leverage their large social media followers. By doing so they will be able to better monetize NFTs and get a piece of the action. Dream VR, for example, offers VR/360 video based athletes channels. More precisely, Dream VR enables athletes (e.g. Dani Alves) to have their own VR/360 channel where they can provide exclusive “behind the scene” virtual VR/360 video content and associated content (jerseys, hats, VIP events..) or provide virtual lessons to their fans. Each fan can just pay a fee per month to get access to all the content. Dream VR is now creating immersive NFTs for Dani Alves (see picture below) related to the experiences and will be located in a small Museum of each city so that they may be purchased at a NFTs Marketplace. Furthermore, users will be able to get inside of those NFTs as if they were part of them. You can check Dream VR’s metaverse experiences here.

Picture: Dream VR, Dani Alves’ NFT. Dani Alves is a Brazilian soccer player (Ex Barca, PSG..)

In 2022 we expect many more athletes to follow suit and launch their own NFT/metaverse channels to sell their own NFTs. This could become a great new revenue generator for many athletes across the globe. It will also be a great way for athletes to better interact with their fans, brands and partners.

Now let’s assume that only 1% of Ronaldo’s 315M followers bought Ronaldo’s special NFTs for $20 each. That would bring $63M to Ronaldo in additional revenue each year.

We believe that many athletes will adopt such models in the coming years in order to improve the fans engagement but more importantly drive their top line. Ultimately we believe that most teams will move towards a Netflix type offering (OTT, VR, mobile, social, eSports..) in order to better monetize their fans.

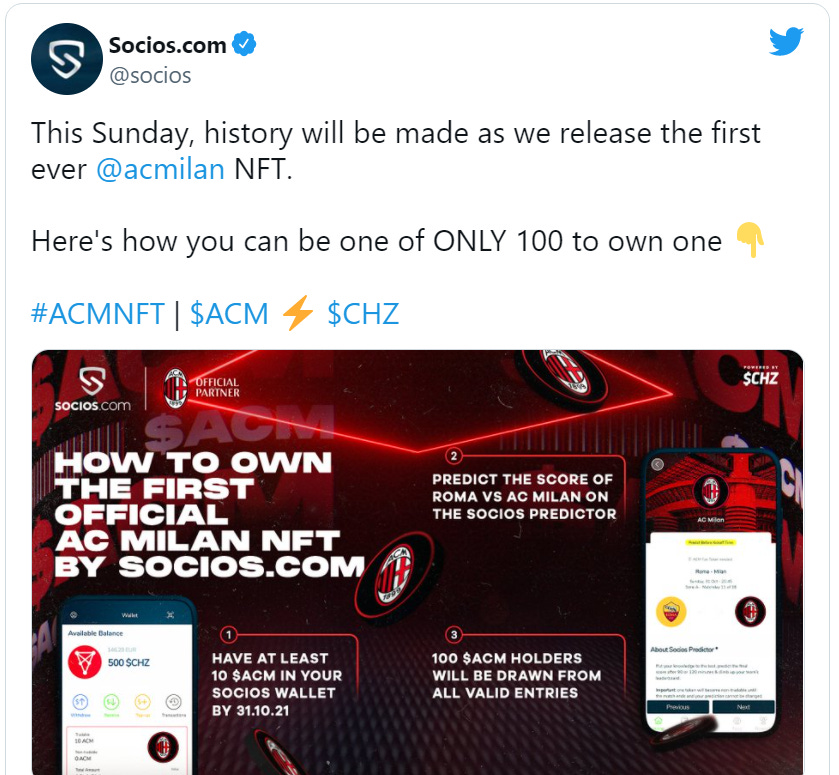

5. Most broadcasters will launch metaverse/NFT experiences during live games:

In 2022 we expect to see more broadcasters offering in game NFT/metaverse experiences which will enable fans to interact live during games but more importantly fans will be able to buy unique NFTs only available during those games. Those NFTs could be sponsored by teams’ main sponsors and partners. We already saw examples of that in 2021 with Socios.com offering live games NFTs. To do so, they teamed with AC Milan and invited its soccer fans to predict the score in order to get a chance to win in game NFTs. Let’s face it! Broadcasters have large audiences. Sports leagues and teams want to get a piece of the NFT/metaverse action so Live TV + In game NFT is the perfect storm.

Picture: Socios.com, AC Milan, 2021.

In 2022 in game NFT/Metaverse experiences is set to become the norm among sports broadcasters. This will help broadcasters, advertisers, teams, leagues and brands to further drive their top line and engage fans in a new way.

6.Instant immersive replays set to become a must have among sports broadcasters:

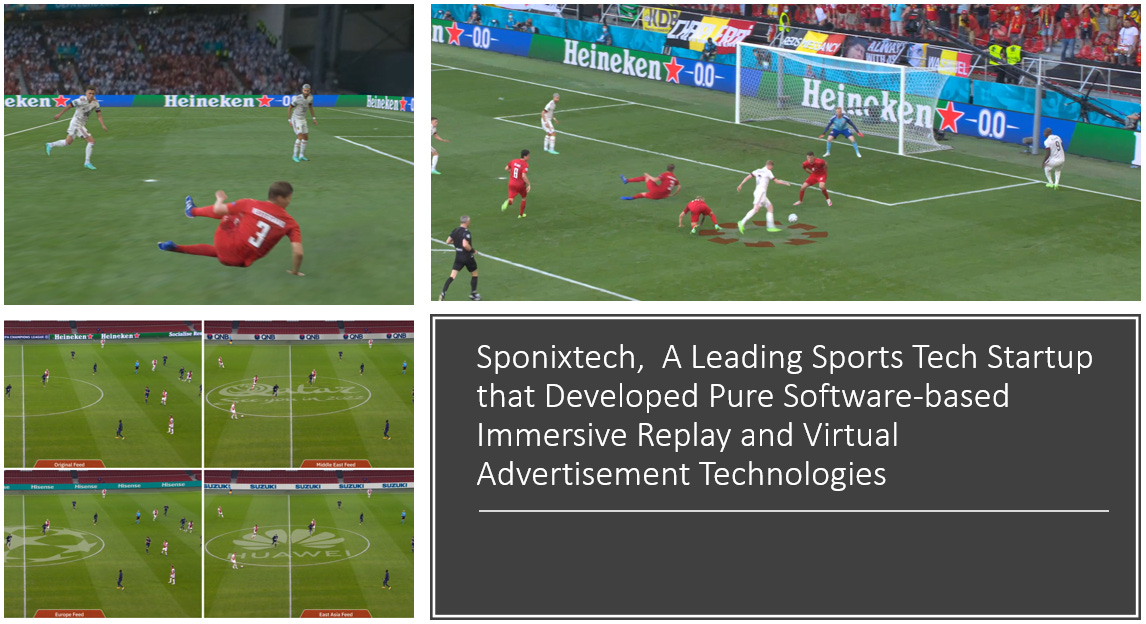

We also believe that immersive replays and virtual advertising technologies, powered by companies like Sponixtech, are set to become a must have among broadcasters in the coming years. It will help enhance the fan experience and monetize content for right-holders.

Here is a video illustrating Sponixtech’s immersive replay and virtual advertising technologies.

Video: Sponixtech

Picture: Sponixtech

7. VR training for soccer set to become the new tool to keep soccer players mentally fit.

We also believe that VR is set to become a new secret sauce for many soccer teams looking to keep their players mentally fit, especially during injuries. One of the key VR players in this emerging space is MiHiepa, which built a VR training system for soccer called Rezzil.

One manager who has used this VR system already in the EFL is Gary Bowyer, the former Blackburn Rovers and Blackpool manager. His players were equally enthusiastic:

“They’re in the generation of virtual-reality computer games so there was buy-in automatically,” explains Gary Bowyer, the former Blackburn Rovers and Blackpool manager who points to the possibility of using VR to maintain both the sharpness and morale of injured players. “For the players that were out injured it provides the opportunity to still feel they were doing some football without actually risking further injury or worrying about the load. Plus there’s the motivation – it’s something different. We set a league table up so straight away there’s competition and it generates a spirit among your players.”

MiHiepa founder says: “If your player is injured, mental sharpness might fall over the eight or ten months of an ACL injury but why can’t we keep them mentally sharp just because they can’t physically be sharp?”

MiHiepa founder presents an intriguing vision of the future, one where substitutes might don headsets and perform warm-up exercises in the tunnel before taking the field.

Or where new players can step into virtual match situations alongside their team-mates to speed up the settling-in process. “A player might sign on a Friday and have to play the Tuesday, but how is he going to get the information?” says MiHiepa founder. “The easiest way is not to sit in a room with a screen but to put him in there on his feet. When a player has just come over they say ‘it’ll take a couple of months to get up to speed’ but you can have a virtual playbook – ‘Here’s how we line up for corners, here’s how we stand up for free-kicks.’ If you’re a right winger, you can see where the keeper is going to aim.”

Picture: Rezzil’s VR training system for soccer

There are also exercises designed to instill resilience, for example, by helping younger players get used to the noise and pressure of a stadium on a match day. One exercise places them in a situation where they must decide what to do with the ball – amid loud shouts of “pass” and “shoot”.

“We are trying with the academy level to make you confused and see how you react,” says MiHiepa founder. Indeed Rezzil is a virtual development tool for academy players featuring five drills which simulate pressure situations.

We believe this type of VR training system for soccer can become very useful for injured players who need to stay mentally fresh. Generally speaking, we believe that these VR training system will incorporate live biometric data and neuroscience / neurofeedback mechanisms to help coaches improve their players’ mental toughness, better understand what makes certain players mentally better than others to help the other players up their game and be in the zone during money time.

8. DNA sequencing set to grow in popularity among soccer teams:

Another key tech area which we believe is set to gain in popularity in the world of soccer is DNA sequencing. As we noted previously, based on conversations that we have had with several vendors, the results have been very promising so far. For example, a major international soccer team has used DNA testing on several players. The result? It has helped this particular team better provide custom nutrition plans to players and ultimately improve the individual performance of players. Generally speaking, we believe that the sports genomic market is still in its infancy as a limited number of soccer teams have so far adopted DNA testing. The biggest challenge for higher adoption remains awareness and data privacy. That being said, based on our feedback we are seeing an increasing number of teams looking at potentially using DNA testing to supplement the work they are already doing to improve training, nutrition and sleep. This is why some vendors like DNAfit have already brought in soccer stars like Rio Ferdinand to be their ambassador in order to drive the awareness of the company and the work that they are doing in the DNA sequencing market. We expect to see more soccer players follow the footsteps of Ferdinand in the coming years.

Video: DNAfit

9. Advanced injury prevention systems (biomarkers, EMG sensors, thermography, blood analysis…) set to become a “secret sauce” for most soccer teams:

As we noted before in the world of pro soccer we expect to see more teams adopt advanced biosensors capable of measuring new types of data such as hydration, electrolyte, lactate, blood pressure, and so on. One of those companies is FLOWBIO, which is developing the world’s first real-time sweat sensing platform. Their product, the FLOWPATCH is unlocking the next generation of human performance data starting with total body fluid and electrolyte loss. The FLOWPATCH consists of a single-use sensor (to ensure maximum accuracy of data) and reusable electronics, which analyses the signals coming from the sensors and processes + streams the data and hydration recommendations to a smart-watch, bike computer or phone.

Here is a video demo of the product in the field.

Another big area where we expect to see great adoption from teams is around EMG sensors built by companies like Neurocess, Strive, Myontec and others.

Here is a video illustrating Neurocess’ sensor based solution to assess players’ injuries.

Video: Neurocess

Neurocess offers services as a wearable technology product that increases the training performance and reduces the risk of injury. Its product provides a sports activity analysis platform through a wireless EMG-based sensor network optimized for athletes. The developed bio-sensors is assisted by advanced signal processing methods to capture physiological data from the muscles accurately. They are using the electrical signals to extract important physiological and biomechanical features such as localized muscular strength, force, fatigue level, dehydration, conductivity, muscular stiffness, muscle recruitment with respect to time. Unlike companies like Strive or Myontec, Neurocess does not require athletes to wear a compression short. Their EMG sensors can be applied on specific muscle types which is a key differentiator. You can listen to the full podcast interview with Neurocess CTO Mert Ergeneci here.

Another emerging area where we also expect to see great adoption is around thermography technologies. ThermoHuman is one of the leading vendors in this area.

Here is how Ismael Fernandez, CEO of ThermoHuman, explains how ThermoHuman and Thermography works: “It’s based on the analysis of temperature. So we built metrics based on mainly asymmetries. Theoretically our body should trend with a thermal balance based on the homeostasis principle. So based on that, your left shoulder or left knee should has more or less the same temperature as the right shoulder or knee. So with that in mind, before the athlete starts feeling some discomfort or some pain, we should see this imbalance of temperature. That’s what’s incredible. Here we are talking about a few Celsius degree differences. So obviously there are a lot of temperature differences on the areas of the body. But we are essentially using thermography, and we are not just looking at the color changes, but we built specific metrics to do that. Then from the beginning, what we saw is in order to extract the metrics, you should analyze the image manually. That is something that you can do if you have one staff member dedicated to this task, but obviously if you want to analyze 25 players and you want to get the results as fast as possible, you need a software”. You can listen to the full podcast interview with Ismael here.

Here is a video explaining how Thermohuman’s technology works based on advanced cameras and software:

Video: ThermoHuman

Lastly we also believe that blood analysis will be another key area where we expect to see more teams and athletes adopt such technology to help reduce the risk of injuries and measuring players internal load.

One of the leaders in the space in Orreco. They are blending Data Science and Sports Science to generate customized indicators of injury, optimal training load and recovery strategies. Orreco also recently launched a new app called @thlete tailored for athletes that helps them analyze their sleep, nutrition, load and much more.

Picture: Orreco’s new app.

From rookie players to veteran pros, they help elite athletes tolerate the physical demands of the professional leagues, accelerate recovery and extend playing careers. They use biomarkers, blood analysis, and data science to identify an athlete’s individual thresholds and provide personalized strategies to keep athletes in their peak performance zones. Orreco works with Olympians, Global governing bodies, NBA, NFL and NHL franchises, English Premier League teams, WNBA players, PGA Tour golfers and F1 drivers.

Here is a video on Orreco’s solution:

10. New sleep tech form factors (smart wristbands..) capable of making athletes sleep, set to grow in popularity in 2022 in the world of pro soccer:

In 2022 we will also see new form factors such as bracelets capable of making athletes fall asleep. A leading player in this space is Remedee Labs a French startup that built a bracelet and solution capable of stimulating brain endorphin release, the body natural pain killer. The bracelet also helps increase sleep quality and decrease stress. Of note, Remedee Labs raised $12M to date. The bracelet is already being used by patients in hospitals in France.

Picture: Remedee Labs bracelet and app.

You can watch the video below to see how the Remedee Labs bracelet works.

Video: Remedee Labs, 2021.

We expect to see these types of new sleep tech form factors (smart sleeping mask, etc..) emerging in 2022 which will help teams improve athletes’ sleep, reduce stress and ultimately improve athletes’ performance.

Bottom line: Historically the world of soccer has been one of the early adopters of emerging technologies whether it is related to NFT/, Metaverse, AR, VR, AI, wearables, injury prevention tools, eSports or DNA sequencing. We expect this trend to continue with more soccer teams adopting emerging technologies in the years to come. Now we believe that all these technologies will be able to have a profound impact on those teams’ top line. With that in mind, we believe that ultimately soccer teams will focus more on the technologies that will bring them tangible ROIs and help them drive higher revenue or reduce the number of injuries. We also expect to see more soccer teams to invest in emerging sports startups through their own investment funds. Lastly we believe that more soccer teams will increasingly focus on building global “fashion” brands as part of their global strategy to attract a large audience and drive their top line.

Leave A Comment

You must be logged in to post a comment.