Dear colleagues,

This week we are kicking off a new series where each month we plan to interview athletes and coaches across major pro teams and leagues (MLS, NBA, NFL, MLB, NHL, NCAA, European soccer, South American soccer, pro rugby, pro tennis, pro cricket, Olympic teams..). The goal with each athletes and coaches is to highlight their background, their investment philosophy, their favorite technologies and portfolio startups, their approach towards innovation and the impact of those technologies on their performance, their health, their rehab, mental health and coaching skills. Of note, if you are an athlete or coach, and would like to get interviewed by us, please contact us at julien@sportscouncilsv.com

So our first pro athlete that we are interviewing this month is Thad Young, an NBA player with the Toronto Raptors. Thad is also an investor, entrepreneur, and philanthropist. Thad has been playing in the NBA for 16 years for the Philadelphia Sixers, the Minnesota Timberwolves, the Brooklyn Nets, the Indiana pacers, the Chicago bulls, and the San Antonio spurs. He is also an investor at Reform ventures. Thad played college basketball for Georgia Tech, before being drafted 12th overall in the 2007 NBA draft by the Philadelphia 76ers.

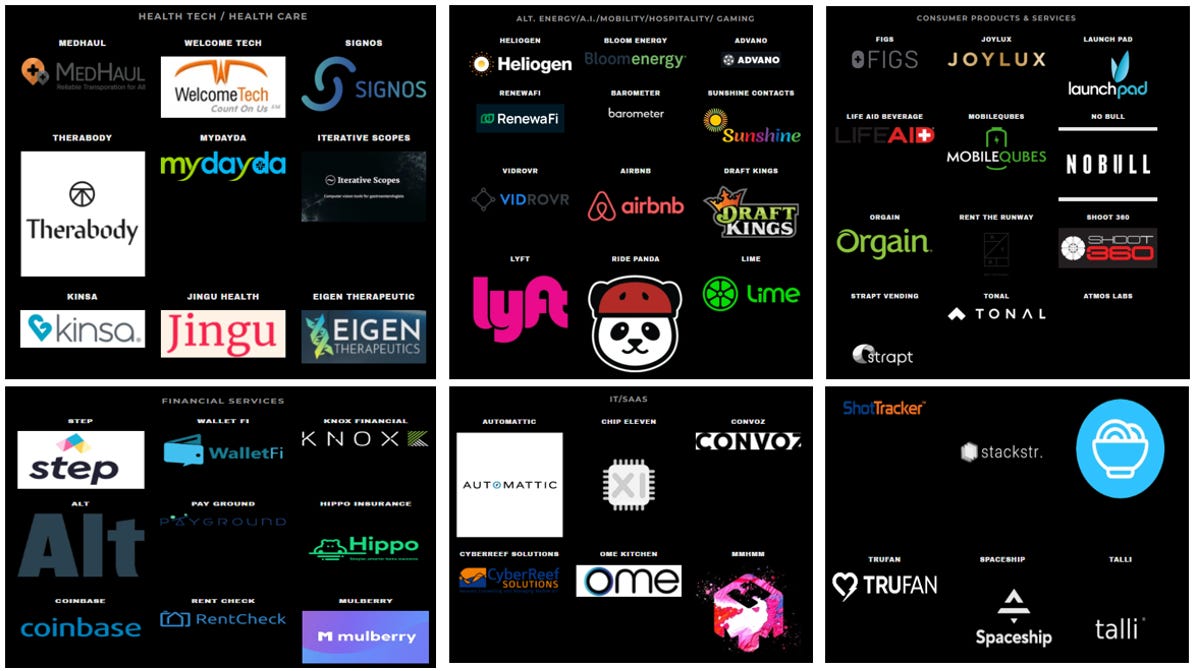

For the past 16 years, Thad has become one of the most active NBA players investing in startups. As shown in the 2 tables below, Thad has now invested in over 200 startups including AirBnB, Dapper Labs, Lyft, Draft Kings, Lime, Coinbase, Epic Games, Plantiga, Coco Delivery, Therabody, Oxefit, just to name a few. You can see his full list of portfolio startups here.

Pictures: Thad Young’s portfolio of startups at Reform Ventures

?Show Notes: Through this interview with Thad, we touched on his background as an NBA player, investor, and philanthropist. Then we discussed the importance of technologies for him as an athlete. We also touched on how he ended up investing in startups and building his own family office. We also talked about how he is doing his due diligence on startups. We also talked about the best NBA players he played against, the best coaches he played for. Lastly we discussed some of his favorite portfolio startups.

Best Quotes: Here are some of the key discussion points and best quotes from our conversation with Thad:

On his background as an NBA player and investor:

- “I am an NBA athlete. I got drafted in the NBA in 2007 as the overall 12th pick (…)

I have played for many different NBA teams, but I am not just a basketball player. I’ve also built an amazing portfolio of investments outside of the entertainment space, which is basketball”.

- I have built Reform Ventures. I also have real estate investments and some cash flow opportunities, which is bringing in things outside of basketball”.

On the fact that he built its own family office and has invested in over 200 companies:

- “I created my own family office where we act as a VC company and we angel invest into a ton of different companies, and try to keep it diverse across the board. I think to date we’ve invested into over 200 companies through funds, funds to funds, direct investments, and regular angel investments from the different groups that we’ve been able to align ourselves with”.

On the fact that he has built a great network of VCs to get a great deal flow source where him and his team evaluate 40 to 50 deals a month:

- “We have several different partners, including some of the top 20 VC firms around the world. We’ve created a really good network and a really good deal flow source for ourselves. We are probably looking at 40 to 50 deals a month”.

- “I am just trying to screen through it with the small team that I do have. It’s been great so far. We’ve seen some really good exits (…) It is been a really fruitful business to be in. And I love the alternative investment side”.

On his goals as an investor outside of basketball:

- “I want to be something bigger than just a basketball player or an athlete. I want to make as much money outside of the court that I’ve made on the court. So that’s one of my goals and dreams. It is to take this thing as far as I can take it as far as investing in, being an entrepreneur and being a business owner and scaling businesses. I love basketball, but I also love the business side of things too”.

- “Basketball is on autopilot for me. I can do basketball in my sleep. But this business, that’s where the real hard work comes in. And that’s what it’s been for me. It is just a bunch of hard work and just time putting into it”.

On how he got the entrepreneurial spirit early on in his life:

- “I was fortunate enough to have some people in my family that stepped in. One of them was my uncle Kenneth Carter. He’s no longer with us today, but he was that person that stepped in and started mentoring me on the business side”.

- “And then there was my dad who played basketball. He understood the basketball aspect of everything. And my mom was one of those tough mothers (…) I’ve always had that entrepreneurial mindset because I’ve always been interested in business”.

- “If this basketball thing doesn’t work out, how am I going to be able to be a provider for, not just myself, but my family so that I will have in the future? So I’ve always had that at the back of my mind with anything that I’ve done from day one”.

On how he applied his high level of discipline as an athlete to the business side:

- “When this thing started when I was 16 years old, it started with me starting to learn how to train as a pro, how to eat as a pro, how to sleep as a pro, how to do everything as a pro. And I took that same approach and put it into the business side. Even with basketball, you watch films and you are always studying. So I’m doing the same thing on the business side each and every day.”.

- “Basketball teaches everything that we need in the business world. It teaches us team building, comradery, leadership skills, life skills, and organization skills. It teaches us all of those things”.

How the importance of technologies for him as an athlete and the state of the sports technology industry:

- “We’re seeing companies just coming out the wazoo. When I first came into the NBA, technology wasn’t as big on the NBA side. But nowadays we use technology for everything, to try to monitor workloads, to monitor how much force a guy is pushing off one leg to the other. We use technology to monitor jumps, runs, or hip symmetry. We are also always taking biometrical scans of our flexibility. Technology is definitely something that’s changed over the course of time and it’s really sped up with COVID”.

- “COVID has sped technology up 10 years by far, and we’re seeing some of the best technologies that I think we have probably ever seen”.

On how he ended up building his own process to do his due diligence on potential startup investments:

- “After my first investment didn’t pan out, I started to gain the knowledge and understood that, okay, I need to ask to have access to a data room. I need to do appropriate due diligence, and make sure all the legal documents are up to date (…) If we need to change something, negotiate the terms, or the preferred stocks. So I had to learn and understand that”.

- “And once I learned and understood that, then you are not just looking at who the founder was, but you are looking at the team that’s behind them. You are looking at their experience, the strategic investors, the strategic advisors, who’s on the cap table and how those people on the cap table have something in common. So it is all these different things. It helped me form the analysis and the reports on potential investment opportunities.”

On his investment team:

- “I’ve formed my own team. They help me a lot. I have two investment analysis guys that dive into deals and pop out one page investment analysis reports for me to look at. And then I have my fund manager who happens to be my cousin, which is perfect because she’s a developer by trade, but she has an MIT degree as well”.

On how he is always looking to invest in the next big thing:

- “When we come up with a conclusion on what companies we want to invest into, how we want to look at the big picture for the next year. For me, I relate to the famous rapper Yo Gotti who is always trying to see around the curve before he gets to the corner”.

- “That’s that’s how we are. We’re the same exact way. We are just trying to see the future before everybody else does. So it’s not about investing into what’s the now, it’s about investing into what’s going to be the next best thing in the next five to 10 years”.

On his favorite startups that he invested in:

- “One company that I’m super excited about is Oxefit. It is like Tonal. And I’m an investor into Tonal and it’s at a 10 x right now. The founder of Oxefit has exited out of three different companies before and all of them were over a billion dollar companies”.

- “The founder of Oxefit is a software guy. He created this Tonal on steroids. They have two hardware products. One is a commercial product and the other one is a residential product. It sits up and it has force plate technology. It does skiing, it does rowing, it does pedal boating. They also have Pilates as well. And you can lift weights on it. It does everything. And you never have to preload a free weight”.

- “I think Oxefit is a multi-billion dollar company. I think they’ve already sold within the first year or two years 1500 to 2000 units. So they’re building a great consumer base. They’re located 10 minutes from my house in Dallas”.

- “One of my other favorite companies is Coco Delivery, a food delivery service that delivers food through drones or robots on the street. And then I like Shoot 360 which is another basketball analytics and technology company who gathers data in real time from a screen”.

- “Another company I like in my portfolio is called Huupe, which is basically built a screen inside of a backboard that tracks all of your data and gives you workouts. You can also play action games where you’re shooting against another person. You can FaceTime with people, you can watch Games or Netflix on it while you are actually working out”.

- One of my other favorite portfolio startups is a Canadian startup called Plantiga that built smart insoles. It is a really good company (…) What we did was that we connected them with another startup I invested in called Move. Jamal Crawford invested in them too. So we’ve connected those two together to try to see if we can get Plantiga to build a Move insole with an insert in it. So the idea there would be to have Move insoles for kids capable of tracking the kids’ steps, and force while using them”.

On the best coaches he played for:

- “I have three favorite coaches. First there is Nate McMillan. He was good to work with. Doug Collins was also a great coach. I think from a preparation standpoint, Doug always had you prepared, he always made sure that you were three games ahead in preparation. I think the biggest thing was that he always worried a lot. But he was a great coach. He gave you a role and what he’s seen in you as a player and he tried to maximize those efforts in your role”.

- “And then obviously there is coach Pop (Gregg Popovich). Obviously he doesn’t have the same teams and the same players that he’s had in the past, but he’s done a great job at building those young guys up over there. For example, I don’t think Dejounte Murray would be Deonte without coming through the Spurs system”.

- “Pop’s team does a really good job of not only preparing you, but challenging you on a day-to-day basis. Everything is always a test. They’re always trying to break you to see how far you can go, and I think that type of preparation has always been great”.

On the best player in the NBA that he has ever played against:

- “I’d probably say the smartest individual is Lebron (James). And regarding the best player as far as scoring, I would say Kobe. And then if we’re talking about the hardest player I’ve had to guard I would say Carmelo Anthony when he was in his prime. By far”.

- “Carmelo was almost unstoppable. He was so hard to stop. Everything was orchestrated and ran for him. So he is going to run off three or four screens, so you are going to get bumped by three or four guys before you even get a chance to guard him”.

On how he is paying close attention to the investments made by other NBA players like Steph Curry and Andre Iguodala:

- “I pay attention to a lot of the other guys in the NBA and their investments in their funds because it’s cool to see what those guys are investing in. Obviously being in the Silicon Valley, the Warriors have really good deal flow. So for example Andre Iguodala and Steph Curry and all those guys have really good deal flow”.

- “But I think I pretty much get all of the same deal flow because I am tapped into the Silicon Valley and California area, as well as in New York and all the different places. So I have a pretty good network where I don’t have to depend on other guys for deals”.

On how he is sharing investment ideas with other NBA players:

- “It is really guys in the NBA just hitting me up for deals, texting me to ask me “Hey, what do you have on table nine? I might send them five deals and say, look, this is what I’m looking at. This is what I’m thinking about as far as check sizes of deals because a lot of guys in the NBA don’t have what I have in place. I’ve built my own family office. And a lot of guys don’t have that”.

Leave A Comment

You must be logged in to post a comment.